World supply and demand fundamentals are favourable for New Zealand’s dairy exports for the rest of 2018 and might continue for some time, dairy analysts say.

Milk supply growth across the big seven producing regions has slowed and the pace of growth is below expectations in the northern hemisphere spring, Rabobank senior dairy analyst Michael Harvey, in Melbourne, said.

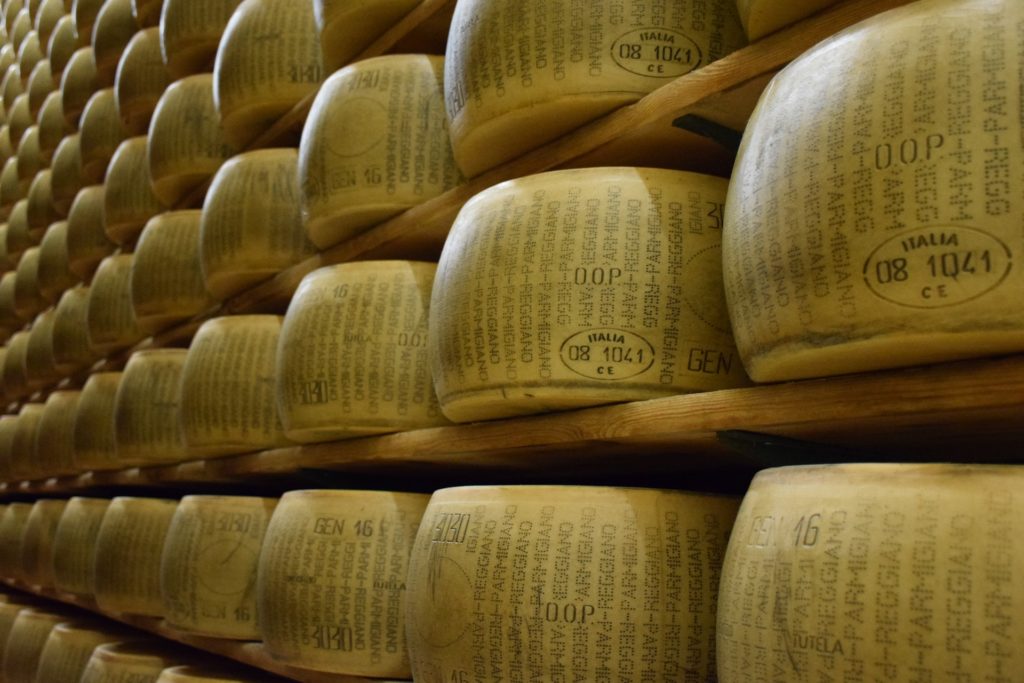

World prices have lifted in the second quarter of 2018 with butter and cheese doing the best.

The European Union has made inroads into its stockpile of skim milk powder and premium prices are being paid for Oceania-sourced cheese and skim milk powder.

Forecast farmgate milk prices have increased.

Fonterra NZ opened the new season with $7/kg milksolids and Fonterra Australia opened with A$5.85 and made a prediction of $6.20 (NZ$6.66).

Saputo Australia opened the new season on July 1 with $5.75 for both its new former Murray Goulburn and existing Warrnambool Cheese and Butter suppliers.

It will take some time for dairy farmers to respond with higher milk production and Rabobank expects growth in the major exporting countries to be positive into 2019 but at a manageable level and in line with consumption trends.

“Overall, the market fundamentals point to a period of relative stability in global prices.

“It may take a major weather event – particularly during the Oceania spring – to see a major shift in price direction as 2018 comes to an end,” Harvey said.

Rabobank raised China’s annual net import growth requirement for 2018 to 16.7% in liquid milk equivalent terms, including 22% in the second half.

ANZ rural economist Con Williams, in his final AgriFocus publication before leaving the bank, said global milk supply is growing at or slightly below trend and that supports the durability of the pricing cycle.

Forecast solid demand in key world markets and a lower NZ dollar will support the milk price, which ANZ forecasts will be $6.75/kg.

Williams projected that to a cashflow for a fully paid up Fonterra supplier of $7.15 and a solid average farm profitability before tax of just over $2000/ha, the highest since 2013-14 and the second-highest in the past decade.

To extend the good news, he raised the medium-term milk price view to $5.75-$6.75 on the basis of the lower NZD, milk price manual adjustments including premiums for products sold outside the GDT channel and solid prospects for international pricing.

NZ milk production could be due a bounce-back after two seasons of decline but the risk factors are spring/summer weather, high empty cow numbers, continued culling because of the spread of Mycoplasma bovis and new palm kernel feeding restrictions.

The Ministry for Primary Industries highlighted the strength of China’s demand for NZ dairy products in its Situation and Outlook report in June.

China is the number one market for NZ dairy products taking 28% of exports. Its imports from NZ are made up of whole milk powder 33%, butter, anhydrous milk fat and cream 20%, skim and butter milk powder 29% and infant formula 36%. Australia takes 32% of infant formula and Hong Kong 19%.

China is NZ’s biggest market by value, $4.65 billion in the year to March 2018, followed by Australia at $1.16b then the United States, Japan, United Arab Emirates, Malaysia, Indonesia and Philippines.

Infant formula exports rose by 50% to $1.2b in the year to June and MPI forecast further increases to $1.4b and $1.5b in the four years ahead.

NZ is now the second-largest provider to China behind the European Union with its strong growth by companies from the Netherlands and France.

MPI forecast export revenue for dairy will be $16.6b in the year to June 2018, up 13.6% on the year before.

It then predicted revenue will rise a further 3% this season to $17.2b, stick at that level for a further season then rise 3% in 2021 and 2022.

Along with the expectation NZ milk supply will not grow significantly, the conclusion to be drawn from the MPI revenue projections is that farmers could enjoy about $7/kg in each of the five seasons ahead.

The immediate forecast of $7.06 for 2018-19 would generate $350,000 operating profit for the average dairy farm.

“It should provide farmers with greater ability to invest in more resilient farming systems and pay down debt,” MPI said.

Article sourced from www.farmersweekly.co.nz