The slowing of global trade continued in August, especially if some one-off effects that boosted fats and cheese trade are taken into account. Slowing trade comes as milk output in major producers starts to expand, economic conditions and trade disputes get a little worse. The outlook for commodity product values is mixed as fat values seek demand traction and protein values firm with reducing stocks.

SMP

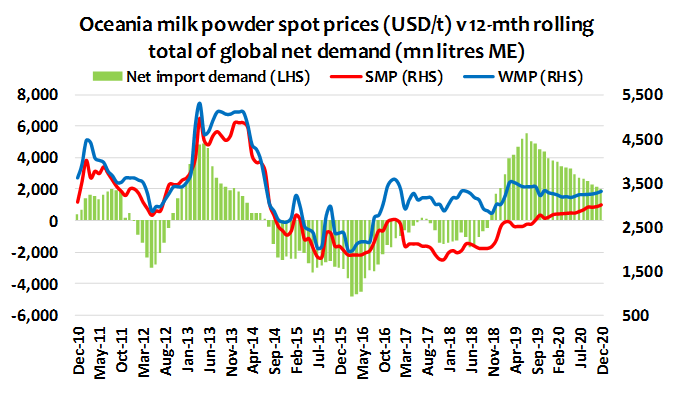

SMP prices should steadily trend firmer, despite improving growth in fresh product availability and slower expansion of trade. SMP demand growth in Asian markets has slowed, although EU’s share of available trade remains high.

WMP

Milk production in New Zealand will be close to prior year levels through the peak of the season but, as always, postpeak weather will be a huge determinant. WMP markets remain finely balanced, highly dependent on sustained Chinese demand, in turn helped by changing milk use and rising local farmgate milk prices.

CHEESE

Cheese prices continue to diverge reflecting different stream return economics in each major producing region. August trade lifted 3.5% YOY, which was back to the average rate of expansion in trade over the prior 10 months. Despite the growth in month, trade in the August quarter was flat against the 2018 comparable after two quieter months. However, this is not a return to stronger underlying activity. Trade between the EU and US was the biggest contributor to growth in the month with the rush to get stock into the US market before the imposition of retaliatory tariffs on EU cheese. All other markets cancelled each other out in August.

BUTTER

Butterfat prices have steadied as domestic EU demand rallies. The EU balance sheet should improve but demand and supply growth will be closely aligned. While EU prices have steadied with better domestic demand, export demand remains weak and may not gain traction without further falls – especially for NZ product.

WHEY

The decline in global trade in whey products in 2019 was 7.1%, mostly the result of weaker shipments into China which imported 27% less, due to the culling of their pig herd to address swine fever and the imposition of punitive tariffs. Chinese trade was also down 27% in August.

By Dustin Boughton, Procurement, Maxum Foods – Your partner in dairy