Market fundamentals through the coming quarters are expected to remain mostly supportive of prices. Despite the profound challenges posed by the tangle of ground and sea logistics affecting most major supply chains, it is difficult to see any major disruption in the supply & demand landscape that could upset these settings through the remainder of 2021 and into Q1-2022.

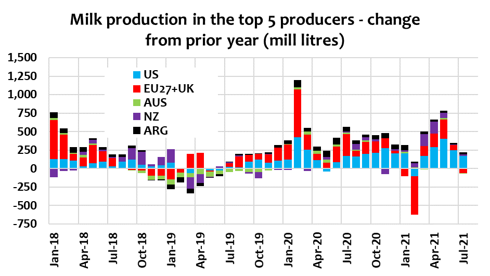

Northern hemisphere milk production will grow at a slower pace while much focus in the short-term will be on the NZ season. Despite the ongoing race to vaccinate populations, the worst affected food market channels will continue to gradually recover as new rules for living with COVID become accepted, while the damage to incomes will affect affordability.

Demand for dairy commodities remains steady as a gradual shift towards eating-out continues, although the challenges of managing the Delta variant of COVID (and others that will emerge) in unvaccinated populations will mean continued restrictions impact foodservice channels – whether imposed or through self-imposed avoidance.

China’s expanding demand remains absolutely critical to the global market balance. Despite an apparent build in powder inventories, major shifts in internal milk use remain supportive of ingredient imports.

There are already tight SMP supplies in EU and NZ, and next the US will tighten. The fundamentals are good for SMP with Chinese and SE Asian demand although landed costs (with hiked freight charges) are in new territory.

US milk is quickly tightening. Cheese and butterfat balance sheets should improve with stronger food service patronage, as the US herd contracts a little and challenging feed costs and quality hamper yields.

NZ milk supply remains a lottery – strong farmgate prices will drive as much milk as possible but there is a watchout with a shift to a drier seasonal outlook which could crimp peak milk and early shoulder-season output.

By Edwin Lloyd, General Manager Commercial, Maxum Foods – Your partner in dairy Graph Reference: Fresh Agenda