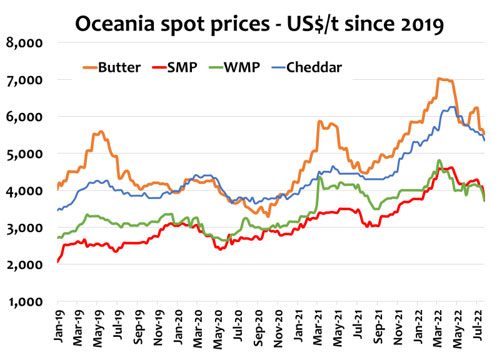

The world dairy market has seen a softening in commodity prices. While tight conditions in the EU will remain a strong influence, weaker fundamentals in the US and Oceania ensure a more diverse situation. Fundamentals have been weakened by both supply and demands-side factors.

The demand-side of the outlook has been weakened by the delayed recovery in import demand due to China’s COVID policy. This is not only the result in recurring restrictions on movement but consumer reluctance to dine and shop outside, reducing demand for dairy. The changes in milk use will delay the requirement to import ingredients, as well as butterfat and cheese. This has already resulted in weak GDT demand, driving WMP and SMP prices lower in July events, and further short-term weakness remains a risk.

US market fundamentals have quickly loosened. While the effects of war continue to drive elevated feed and energy costs, fear of recession drove a sharp fall in feed grain prices in July as part of the global sell-off of commodities. This has improved milk production margins in coming months and supports a stronger return to milk growth in H2-2022 than expected given weak comparables.

The weaker sentiment for milk powders reflected in futures markets has been further fostered by destocking of supply chains in domestic and some export markets, reducing “disappearance” of product in the short-term and allowing buyers to wait for cheaper prices. Demand in sensitive markets is expected to be further impacted, however recent declines in prices may alleviate some of that risk.

The EU outlook remains the most complex and uncertain. Poor weather and elevated input costs will mean little or no growth in manufacturing milk, while sustained high energy costs will continue to pressure EU SMP and butter output. NZ milk output for the 2022-23 season remains in the balance but the recent weather increases the risk of a poor Spring. The expected record milk prices are unlikely to drive stronger milk output as a poor season start, higher costs, scarce labour and physical limits will constrain production.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view a PDF of this release, click here.