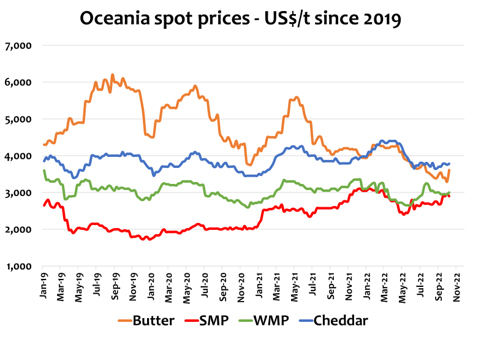

Short-term fundamentals have weakened a little, with a little more milk availability while the outlook for demand in the domestic markets of major producers and in China is weaker.

Most of the focus of weaker sentiment remains on the demand side with the fear that consumers will react higher costs of living by trading down to cheaper dairy products and meal options and avoiding some discretionary dairy purchases. Inflation is close to peaking in both the EU & US but impacts on spending are (so far) mixed.

It is expected that EU domestic cheese and butter demand impacts will worsen in H1-2023. Meanwhile cheese demand in the US so far appears resilient, as demand shifts to lower-priced lines and a stronger emphasis on mozzarella which is helping keep cheddar relatively balanced.

While those domestic markets consume a dominant share of tradable milk solids, the unpredictable situation in China will remain in focus, especially for its influence on Oceania prices and milk use. China’s government announced a gradual easing of COVID restrictions, but since shown that it will continue with harsh and futile restrictions to limit the mobility of its people – and limit the recovery in demand for dairy in the short-term.

Supply-side conditions are diverse as global milk supplies steadily improve. Milk collections in the top 5 exporters are expected to grow near 0.5% in Q4-2022 and by close to 1% in H1-2023. There are however headwinds for milk producers. This milk growth on top of weak Chinese demand for WMP is adding to available SMP and butterfat.

NZ milk output was near to 4% weaker over the production peak, but milk supply may improve in late summer with the forecast weakening of La Nina’s grip, although feed shortages are apparent. EU milk supplies have quickly improved (compared to the weak output this time last year) with a boost to feed availability in warm autumn weather which should improve stored forage through winter. While US output is also expanding, the growth in cow numbers is small. Per-cow yield gains may slow with weaker milk producing margins in coming months.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.