Market sentiment has weakened in the global market but there has been little change in short-term fundamentals.

While demand has pushed back against high product prices, ideal European autumn weather and lower feed prices has bolstered feed reserves and continues to benefit milk supply. As cheese and butter demand slowed, SMP and butter stocks have increased.

EU cheese demand is now more critical to global fundamentals. If it worsens and more milk is sent to milk driers and butter churns, market recovery in commodities will be slower. Buyers with cover can sit and wait for the bottom.

The timing of a revival in China’s powder demand is the biggest factor the market is now betting on. Futures markets are consistent in expectations of steadily rising values by mid-year, pricing-in the return of Chinese buyers and some slowing in milk output to tighten WMP, SMP and butterfat markets. There may not be a uniform upswing, as there are stocks of WMP to work through. China’s overall demand has slowed but consumer activity is improving.

The SMP balance sheet is the major worry going forward. Higher SMP production in NZ and the EU and the slump in demand (export and domestic), have added significantly to world stocks – compared to the tight situation in the prior year. Trade improvement may take a little while in 2023, as many buyers wait for a clear sign the market has bottomed.

Butterfat seems less a challenge – most of the increased availability for trade was already soaked up in the 2nd half of 2022, and lower prices will help in the coming months.

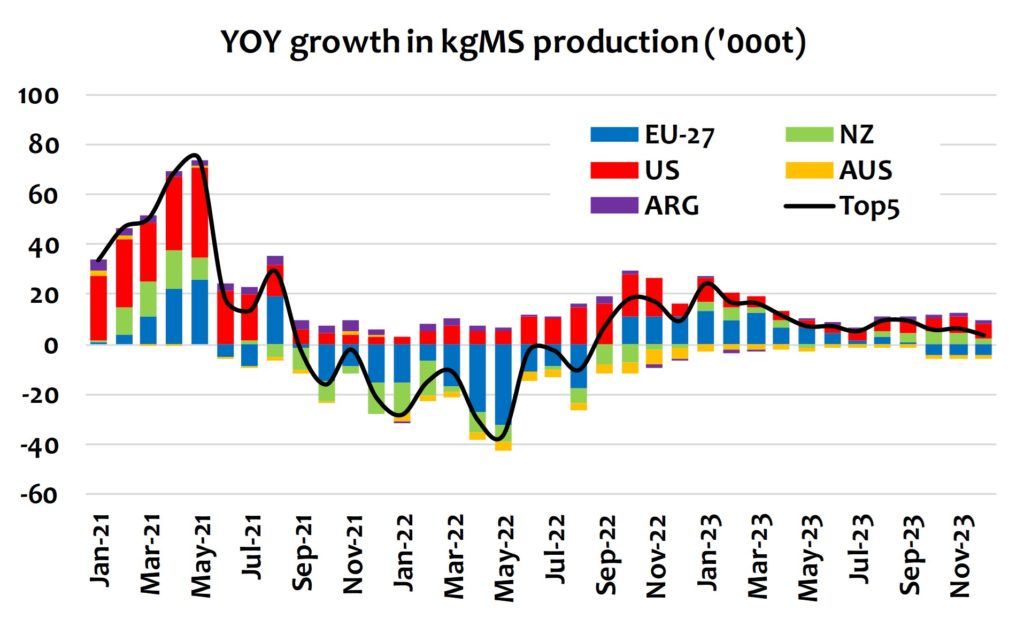

The current surge in milk supply may not last long. On-farm pressures could easily return in H2-2023 as EU and US producers face tighter cashflows and (in the EU) possibly less spring pasture. Feed grain prices are also uncertain, depending how the Ukraine war develops (and if food and energy are again be used as leverage). In the meantime, the corn belt in the US is historically dry and South American crops are threatened by the final fling of La Nina. US milk output is already slowing, ensuring more milk goes to putting cheese on pizzas and producing less milk powder.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.