Market sentiment improved significantly in February. However, there was little apparent change in the short-term fundamentals and our outlook in terms of projected values has not significantly altered.

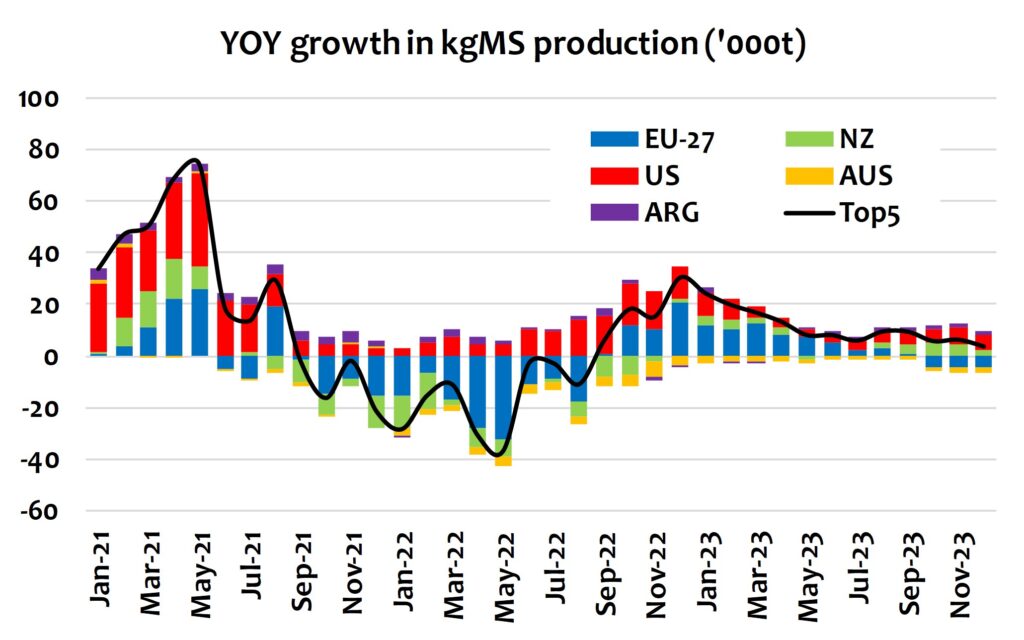

The big bet on China’s rampaging return to buying milk powders has been snuffed out and it seems now we’re set for the reality of a gradual rebalancing of the world’s milk solids towards tighter supplies. Slowing milk output in the EU and US, and more difficult conditions in NZ will help.

The many EU market variables continue to be a major influence on direction. The surge of milk supply in late 2022 is easing a little through winter but there is much uncertainty ahead as to the strength of the spring flush. Milk prices are sliding towards underlying product values, feed prices have eased, and fertiliser prices are at last more affordable, such that the supply response to these factors remains a lottery. A recovery in cheese demand at lower prices may occur as European households have fared a little better with a mild winter and lower energy costs.

The global SMP market remains delicately positioned. Increasing production in NZ and, to a lesser extent, EU has built inventories while there has been sluggish demand on the global market.

Chinese demand (at least for SMP) is starting to ignite as activity increases, while demand from Southeast Asia remained well below trend in latest data and in GDT events. Food price inflation continues to rise in key import markets and may slow the pace of recovery.

The US cheese market should remain finely balanced as milk supply trends weaker, leaving limited risk of an increase in milk powder production – especially with the water stress in the southwest of the country. US consumers have continued spending but drifted towards higher cheese consumption in cheaper meals.

On-farm pressures will build as the year unfolds with tighter EU and US margins. Feed grain prices are off their peaks but remain elevated and highly uncertain, depending heavily on escalation of the Ukraine war, and weather risks for the US corn belt and South American crops. Market demand vs supply remains very much in the balance.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.