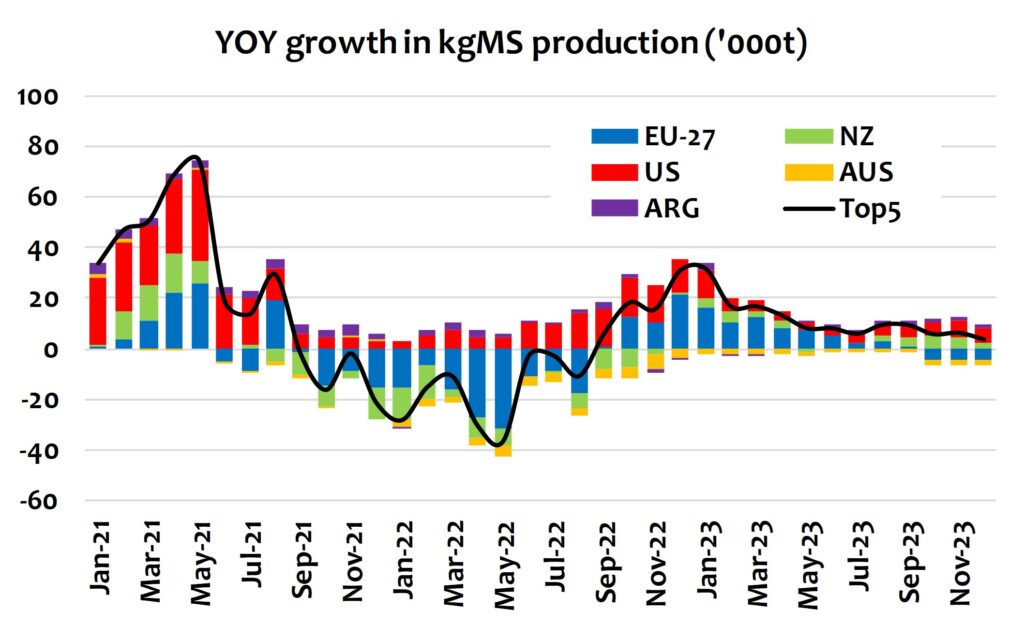

Short-term fundamentals remain but should improve later in the year as global trade recovers and milk production slows.

The largest dampener on the market remains the EU which provides the outlook with a double edge. The EU sector is sending signals that prolong weak commodity prices.

While EU processors continue to encourage their farmers to produce more milk (even though prices are in decline), high retail dairy prices are prompting households to consume less dairy – directly as cheese and butterfat, but also in food categories that consume dairy ingredients. High inflation will linger through 2023, while rising interest rates will further damage spending.

These factors will, in the short term through the spring flush, ensure increased availability of SMP (and to a lesser extent butter) which will probably keep buyers away (especially in SE Asia) until there is a clear signal the market has bottomed.

China’s much-anticipated demand revival is expected to remain slow and steady across dairy categories, and more complicated in the case of WMP as the local milk situation doesn’t appear to be quickly tightening. Food service sales have rebounded to some extent but there’ll be a lot more caution from consumers with a weak property market and employment insecurity.

The pace of the WMP demand recovery has and will continue to have a huge impact on the balance of NZ output. To date that has been slower than expected, increasing available WMP stocks and keeping downward pressure on WMP values. NZ producers will aim to match the WMP demand with their product mix choices, but we expect will keep SMP and cheese output higher than pre-2022 levels – at a time when the EU and US output comes under pressure.

The US milk powder market is exposed to the EU conditions, despite reducing output and strong demand from Mexico for SMP. The cheese market is reasonably balanced despite increasing output from new facilities and short-term fluctuations in availability. Cheese demand appears resilient, demand shifting to lower-priced lines and to a stronger emphasis on mozzarella which is keeping pace with growth in product output.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.