It is overly hopeful to think that improving fundamentals will turn the market in the short-term. Low prices aren’t stimulating demand – there isn’t belief from the market-side that there will be a significant enough slowing in milk supply and an increase in end-user demand sufficient to quickly reverse weaknesses in the global milk balance. In the meantime, the price action will be driven by GDT events which are exposed to weak ingredient demand from Asia.

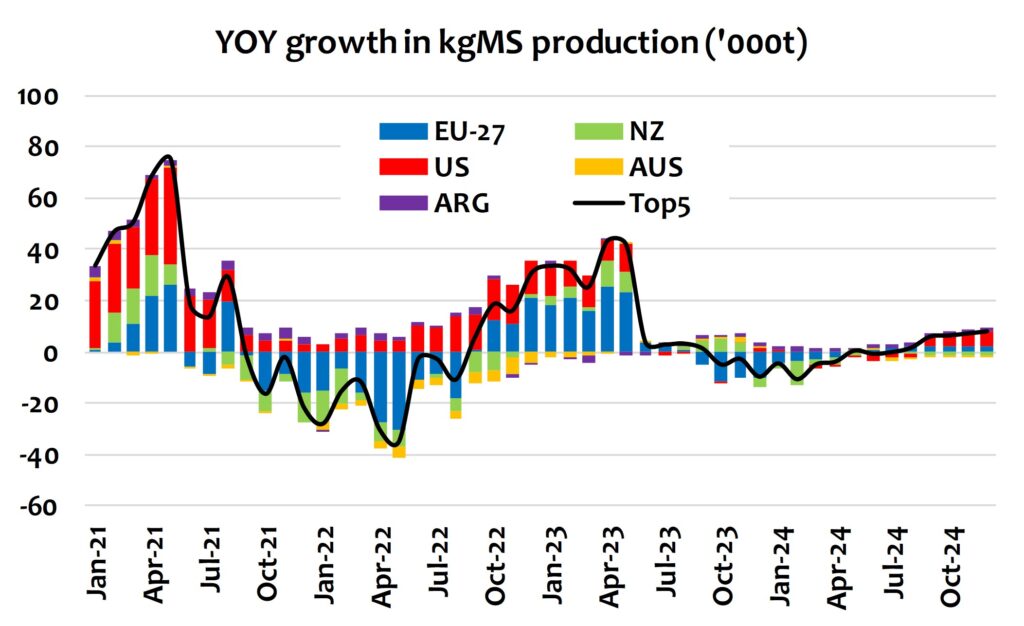

Milk output from the top 5 global producers is expected to be flat in Q4-2023 and through H1-2024 (leap-year adjusted) as lower farm margins slow production. This will slow the production of commodities as domestic cheese markets in EU and US draw on higher milk volumes.

It is far from clear whether EU supply will reduce milk output in the short-term – weather again will be critical as it was a year ago. The brakes on US milk output may not be on for too long. NZ may produce a little less milk due to a poor start to spring and with milk prices now well under the cost of production for most producers.

Global trade has started to improve but is not convincing enough yet to tighten supplies. It’s also pretty clear that China isn’t coming to save the market any time soon.

The outlook for demand from other export markets remains mixed with few signs that Asian markets will recover any time soon. Some country markets are working through stocks and dealing with high local inflation, while the changing climate may push prices of staple foods sharply higher. Meanwhile buyers in other regions such as in MENA and Mexico have been opportunistic and/or to addressing local droughts.

SMP fundamentals in the EU are gradually improving with slowing milk growth and powder production and improved exports. The WMP market is weaker due to reduced demand from China and the rest of Asia.

Butterfat fundamentals are weaker in the short-term with ample EU stocks and weak domestic use, while rising NZ availability is weakening global prices. EU cheese markets continue to be delicately balanced as processors push more milk into cheese vats (due to attractive stream returns) to meet steady domestic demand and improved exports.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda