Global Dairy Commodity Update May 2024

Global fundamentals haven’t altered much since our last update, with the only major change driven by cold and wet weather which will limit and delay the EU spring peak in milk, especially in the UK and Ireland.

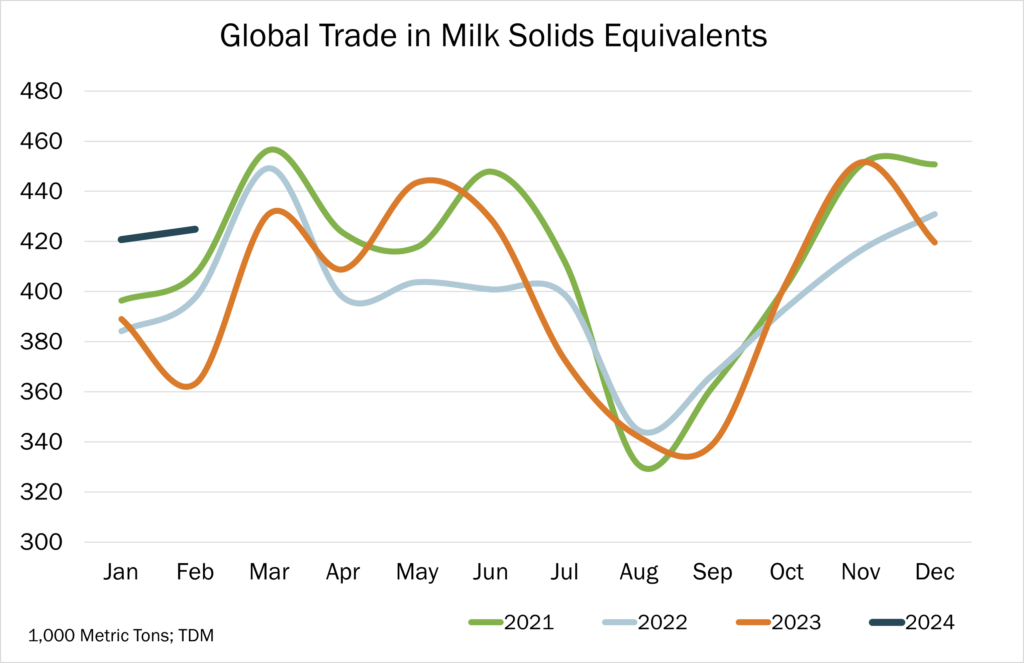

Global trade increased 17% year-on-year in Milk Solids Equivalents (MSE) terms in February and was 6.9% higher over the last quarter. In the past year, trade was 2.8% above the prior year, but this is driven in part by clearing of product at low prices, and compares to a low base through Q1-2023.

EU production is now unlikely to grow year-on-year, but this does little to alter the drift in ingredient and cheese markets. Cool weather has unsettled butterfat markets in the short-term, but warm weather and improved cream demand should stabilise prices.

The weak demand side of the dairy complex is unchanged, despite the significant low-price restocking that has occurred in recent months in some key export regions.

The lack of recovery in Chinese trade remains the major drag on the global balance, with little evidence of any change in the local dairy supply chain.

Firm cheese and butter prices in the EU will test consumer elasticity in the coming months.

The US cheese market remains in focus given the importance of marginal trade to the big three exporters. Short-term cheese prices in the US rallied in April due to supply-side concerns, despite ongoing pressures on consumer spending. The impacts of the Avian Flu situation on consumer attitudes to dairy in the US remains uncertain, as scientific investigation, speculation, and rumor as to the cause and reach of the virus evolves.

It will be interesting to see how the large, anticipated increase in cheese production capacity in the US between later 2024 and early 2025 impacts pricing, milk solids and export markets. The US market currently has the most unknowns since the pandemic.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.