Global Dairy Commodity Update July 2025

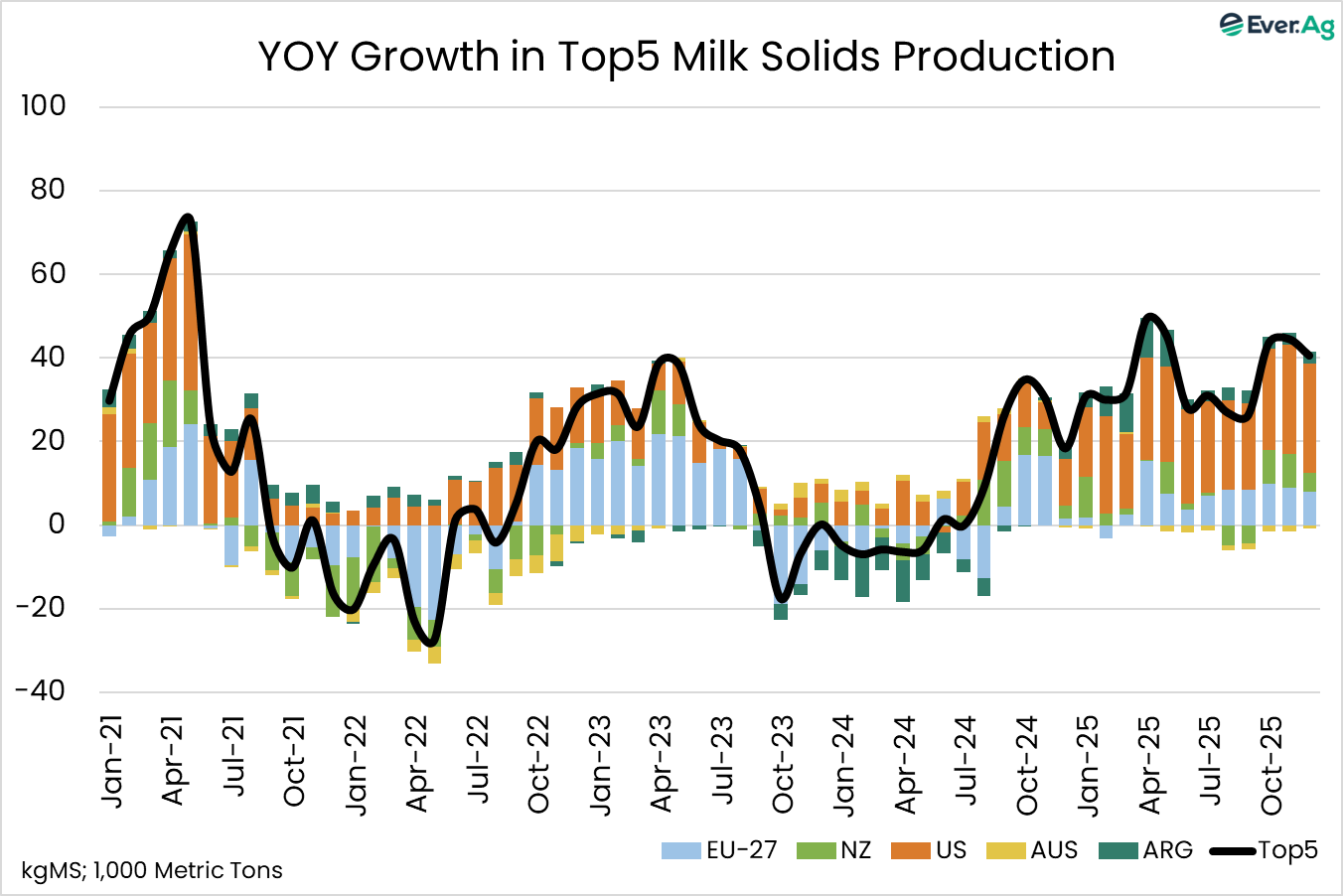

Global market fundamentals have weakened a little as the effects of high milk prices and good production margins will support increased growth in milk output in H2-25. Global markets remain strongly under the influence of tight EU milk and butterfat supplies, flowing onto cheese prices.

Despite some relieving rain, EU milk producers face headwinds as a hot, dry summer threatens feed supplies and raises potential disease impacts. Short-term milk and cream remain patchy but there is now added risk of pushback on high prices.

EU cheese demand has been stable at elevated prices, but exports are far less competitive against US and NZ product.

US milk production is quickly rising, supporting strong cheese output growth in central regions as new plants fill. The short-term market remains volatile as output is growing faster than domestic demand is recovering. Weak fundamentals will keep US cheese prices competitive against EU benchmarks, but there has been little progress to date in re-balancing the US market. NZ exporters continued to capture the largest share of the growth in trade into cheese markets where major exporters go head-to-head.

Production conditions have improved in NZ ahead of the new season, but weather will remain a key influence.

Global trade grew strongly in the first four months of the year, partly to get ahead of potentially higher tariffs, but some pushback against high prices was apparent in NZ’s May export trends. There is still considerable uncertainty as to the future of higher tariffs threatened by the US on several countries including the EU while many “done deals” on trade are claimed. Details remain scant.

Southern Australian region opening milk prices for the 2025-26 season have edged above 9.00/kgms as competition for milk intensifies. Milk output in southern regions will worsen in coming months due to drought which is worst in Sth West Victoria and Tasmania, while new flood risks emerge in NSW. Our milk solids production outlook has been cut and is down 2% in 2025/26, with a lower spring peak given the reduction in cow numbers, but that can easily deteriorate further. The spring rainfall outlook is a little worse in the latest forecast.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.