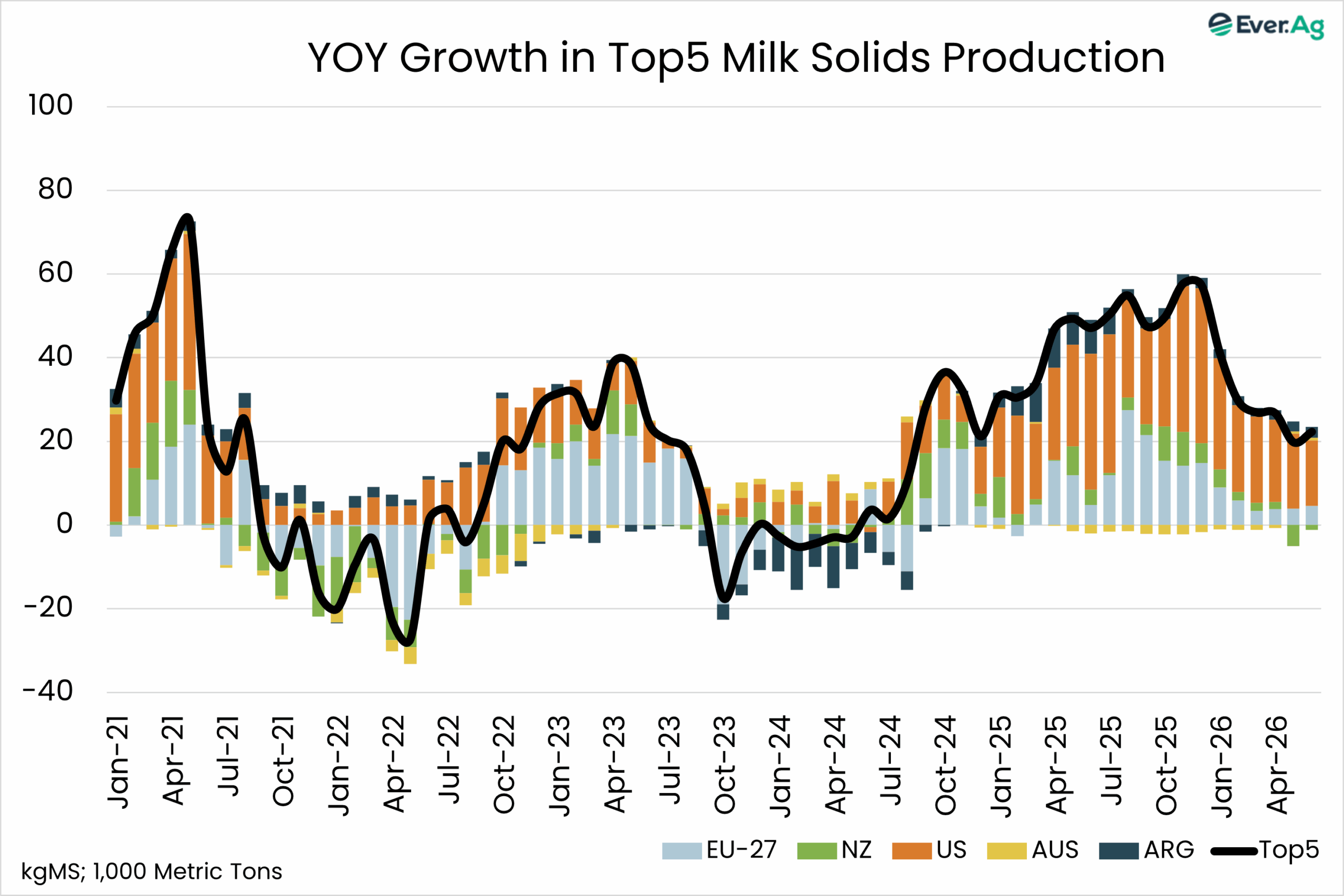

Global Dairy Commodity Update October 2025

Dairy market fundamentals have weakened significantly with prospects for stronger EU milk supplies in coming months. With rising milk production and anemic demand in export markets, while EU butter inventories are building faster-than-expected.

The surge in EU milk supplies is being driven by good milk prices, limited disease outbreaks, a shift in calving patterns, and plenty of cheap feed. By avoiding over-production of cheese, cream and skim solids supplies are abundant, butterfat imports are rising, and EU exporters are losing cheese export market shares.

The US market remains seriously oversupplied, with 2.1% more dairy cows in the herd compared to June 2024 pushing milk production higher. Labor market pressures, persistent inflation, and fewer consumers continue to be drags on dairy consumption. Cheap butter may spur demand in domestic channels and sustain higher exports.

With good pasture conditions and continuing high milk prices, NZ is having another exceptional season start in 2025/26, with interesting choices ahead for product mix given the changed landscape.

Global trade will continue to expand at low prices despite geopolitical and tariff uncertainty. Most of the expansion in recent months has been due to strong demand for cheese and fats however, led by developed markets which can absorb higher prices

The Q4-25 BOM rainfall outlook has flip-flopped and now weakened across eastern Australia, but remains mostly above-average. Temperatures are also expected above average in most areas.

Fodder prices in southern Australian regions are likely to stay under pressure with an oversupplied grain market prompting more marginal crops to be baled.

Cow culling activity continued strongly, increasing 37% in seven months to July. July itself was the highest monthly turn-off in more than 3 years, as cull cow prices spiked. Freshagenda’s milk solids production outlook is for a 2.2% fall in 2025/26, with a lower spring peak given the reduced cow numbers.

By John Hallo, Procurement Business Partner

M: +61 438 038 341

Email: john@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.