Global Dairy Commodity Update November 2025

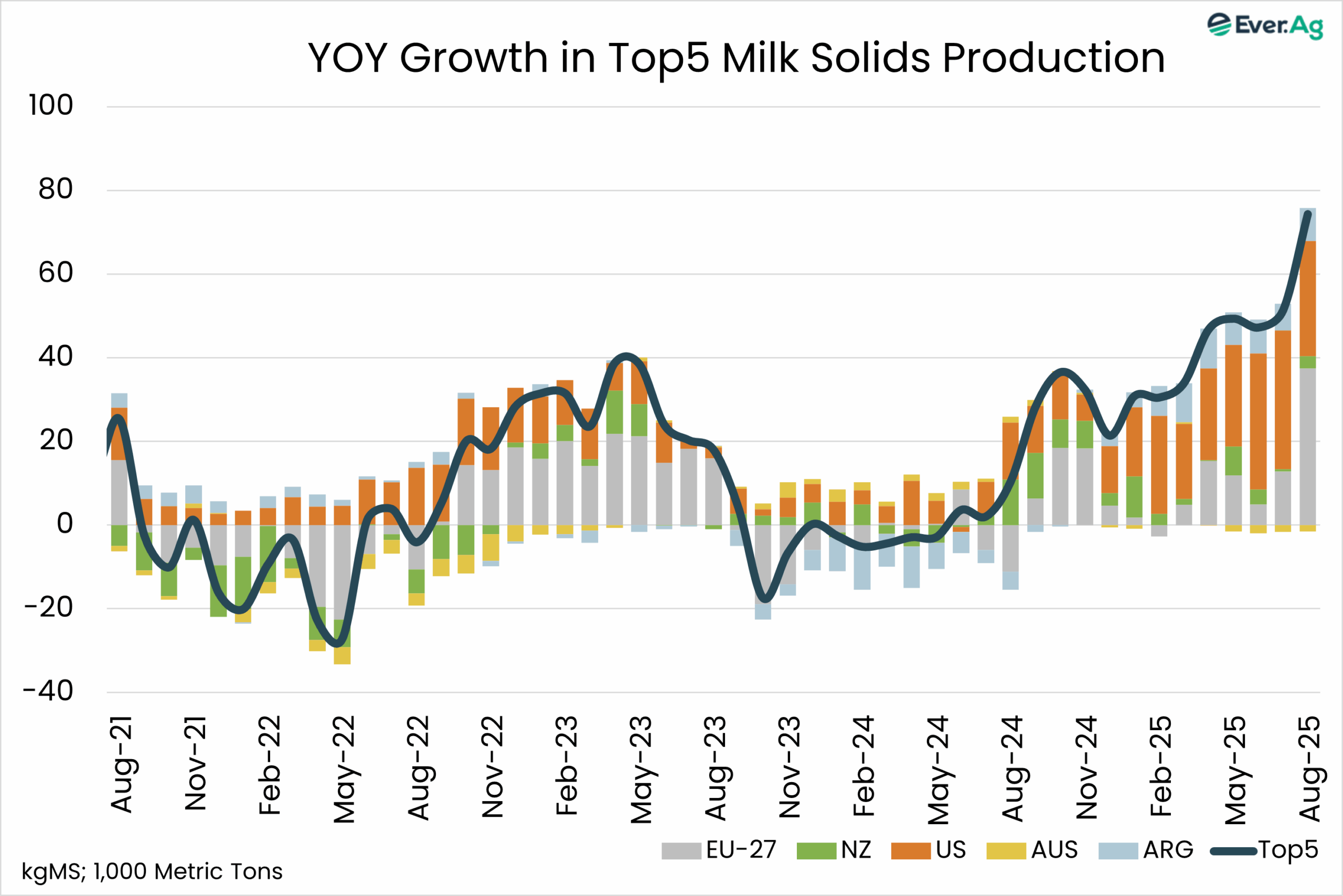

Dairy markets remain oversupplied, and our assessment of global supply and demand suggests further price weakness is likely in coming months. Milk growth is robust across key exporting countries while demand in most markets is under pressure.

EU butter output well ahead of demand growth, and stocks are quickly building. Product prices have collapsed, but retail promotions should spur demand. Farmgate prices are falling, but the supply response may be limited before the next spring flush which in turn depends on weather, feed prices and quality.

The surge in US milk output will continue into next year, but the cheese spot market is likely to be volatile with growth in exports and production plant issues. US cheese and butterfat fundamentals remain weak, with uncertainty of SNAP benefits adding to demand concerns, while the EU is now far more competitive in export markets.

NZ milk solids production reached all-time highs in Q3-25, yet mixed conditions affected peak volumes. With limited improved in Chinese demand for NZ milk powders, post-peak product mix choices will be a key watchout.

In Australia, the BOM outlook for November to January is for above-average rainfall for parts of the east and below average for parts of the north and west. Temperatures are likely to be above average for most of Australia except in parts of eastern NSW.

Local hay prices are falling with an increase in cereal hay cutting, especially with dry conditions during spring. Subdued buyer activity continues, with many farmers holding off fodder purchases until later in summer.

Season to date (July-Oct) dairy cow slaughter increased 23%, but with a 7% YOY fall in October as cull cow prices retreated and pasture conditions improved.

Freshagenda’s 2025/26 milk solids output outlook is for a 1.9% fall, with a lower spring peak given the reduction in cow numbers, but we have doubts in official industry data given our intel on the ground. There have also been large historical adjustments to product output data, suggesting a lot more cheese was produced in prior seasons.

By John Hallo, Procurement Business Partner

M: +61 438 038 341

Email: john@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.