Global Dairy Commodity Update January 2026

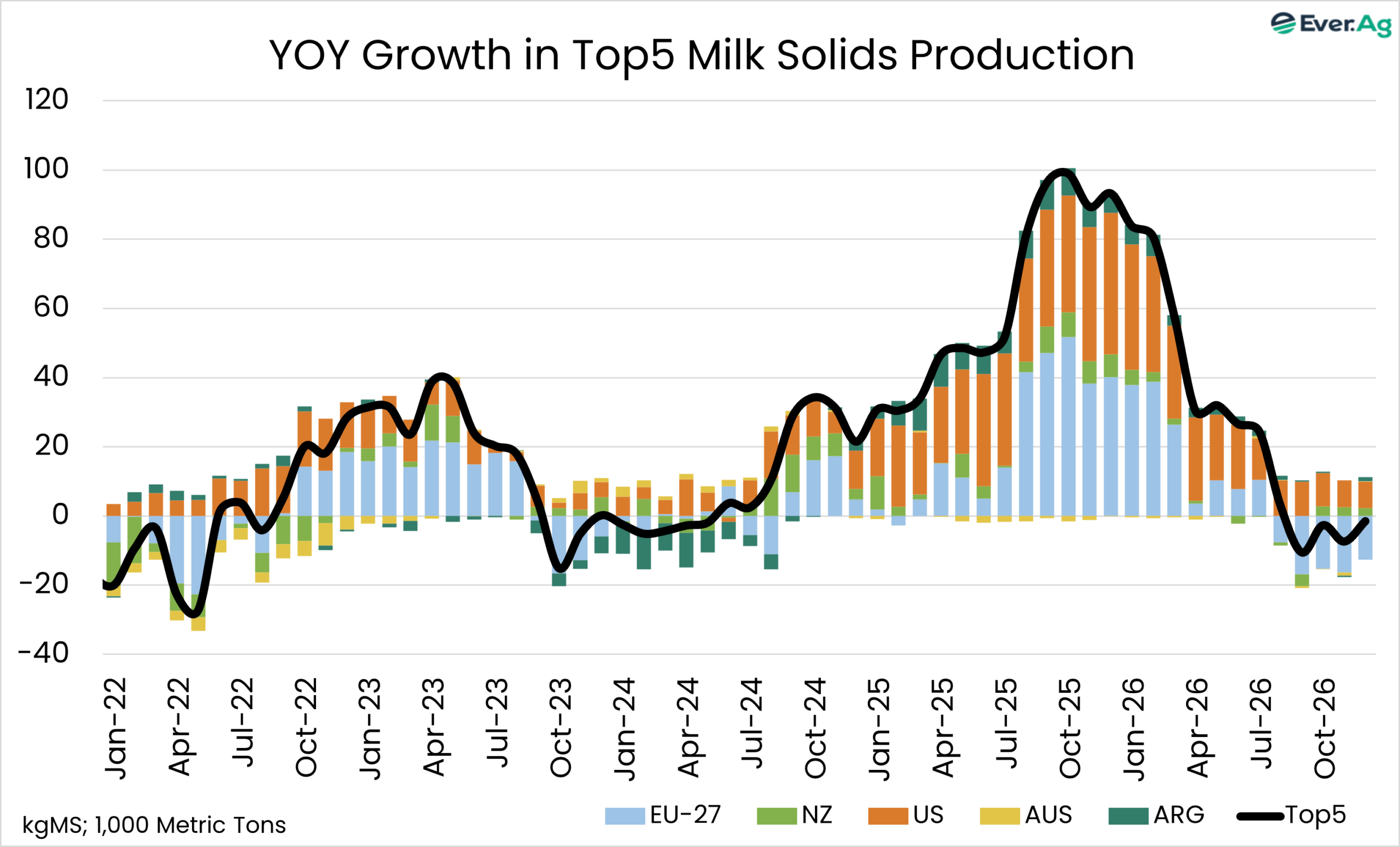

Combined milk output growth by the top 5 global exporting countries has been running at a historically high rate since July. This unexpected supply-side shock along with “so-so demand” in large domestic developed markets lifted exportable surplus and led to a sharp correction in global commodity prices.

In some cases, announced EU milk prices are already below €40/100kg and will continue to fall before farmers increase culling and reduce supply, but short-term revenue focus and cheap feed may delay the process.

China’s new provisional tariffs on EU cream and cheese exports may apply further pressure on global butter prices. The EU started the new year with abundant butter inventories, postponing any meaningful price recovery to later in 2026.

NZ supply remains strong as farmgate prices are still profitable despite recent declines amid poor GDT performance in late 2025. November milk powder exports to China were historically weak.

Lower milk margins will slow US supply growth in 2026, but greater adoption of GLP-1 drugs will continue to pressure demand.

Global trade in late 2025 rose to an all-time high. Increased exportable surplus and lower prices will continue to boost shipments despite political tensions and policy uncertainty.

Australian milk supplies declined through November. The continuing contraction reflects industry exists and dry conditions across Southern Australia but also flooding in the Subtropical and NSW Mid-north Coast regions. Conditions in South-West Victoria have notably improved, with lower cereal hay prices compared to earlier in the year.

Our 2025/26 milk solids production outlook for Australia is for a 1.4% fall, with lower supplies through Q2-26 given the reduction in cow numbers, especially in Victoria.

With lower global product prices, the commodity milk value has declined since June 1 but farmgate prices have recently increased. Opening farmgate prices for 2026/27 are expected to be lower but supported by strong competition for milk in the local industry.

By John Hallo, Procurement Business Partner

M: +61 438 038 341

Email: john@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.