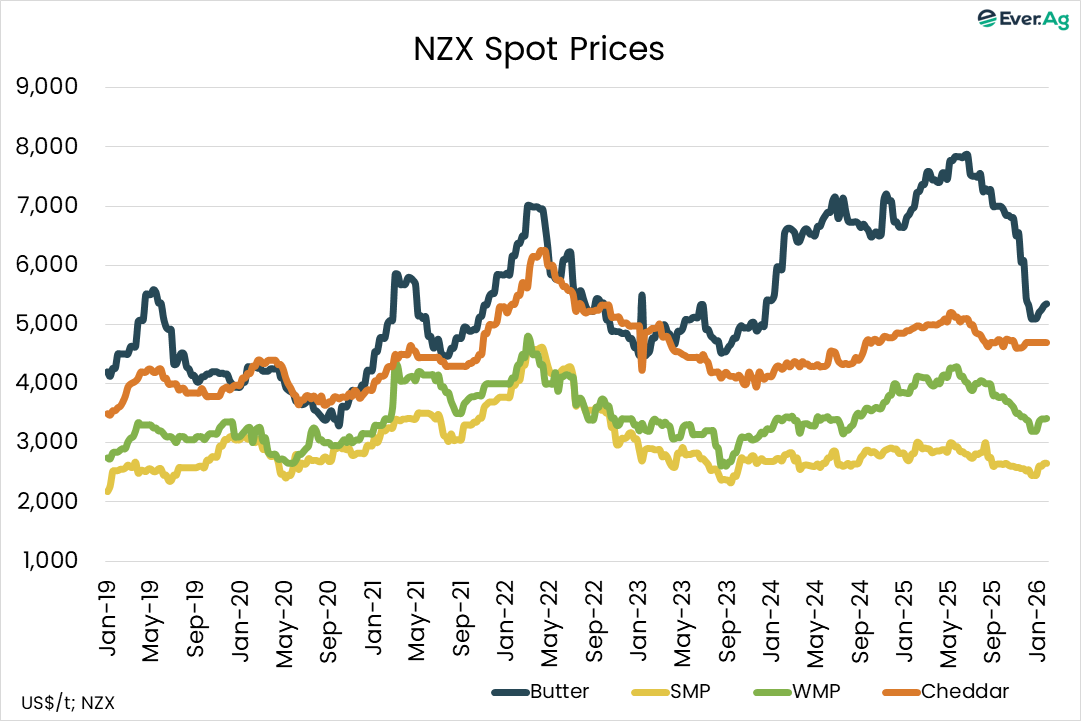

Global Dairy Commodity Update February 2026

Dairy markets remain oversupplied according to our latest assessment of trends in global supply and demand. Nothing has materially changed since our last update, but bullish sentiment is driving the market in the short-term, ignoring fundamentals.

We remain cautious. Combined milk solids output by the top five global exporting countries remains robust and spot liquid prices are cheap. Market volatility has increased, and a short-term price correction is entirely possible.

EU milk prices may have limited downside given the current market rally. Processors are managing cheese production, resulting in SMP/butter output growth with cheap cream and SMC. The EU will enter the peak with heavy butter stocks, overhanging the market until weaker milk growth from 2H-26 leads to a slow price recovery.

NZ supply is seasonally falling but continues to grow YOY with profitable milk prices and strong imports of supplementary feed. December WMP exports to China were historically weak, while North Asia has been buying more product on GDT.

The US herd may expand in the short-term, but strong comparables later in the year will limit milk growth. A plethora of factors are limiting dairy consumption, but winter storms in late January brought forward some demand by retailers and consumers.

After months of declines, Australia recorded 1.8% YOY growth in December milk output, on a low comparable. National supply is anticipated to continue its decline during 2025/26, with a negative medium-to-long-term outlook.

Domestic retail sales are strong, but overall inflation is persistent. July-Nov 2025 cheese exports rose 7%, mostly in China. SW Victoria’s soil moisture remains low, with below average rainfall. Demand is soft with pasture and cereal hay difficult to sell, as markets in western Victoria are fully supplied. The intense heatwave means much of the remaining unbaled standing feed has dried out and lost nutritional value. An emergency warning continues for a bushfire in Victoria’s Otways region with total fire bans and extreme fire danger warnings across the state.

By John Hallo, Procurement Business Partner

M: +61 438 038 341

Email: john@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.