The fundamentals underpinning the global market outlook remain positive but may weaken with improving expansion in milk supply and a slowing in trade in milk powders. However, the outlook for commodity product values is mixed as butterfat values have stabilised, while increased cheese capacity in Europe will keep supplies abundant and may cap values.

SKIM MILK POWDER

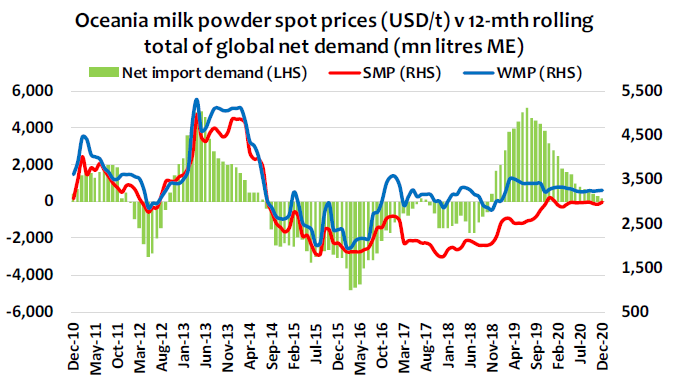

SMP fundamentals recently improved with lower EU and US output and sustained export demand. Going forward, this is new territory with SMP fundamentals no longer driven mostly by the EU stock turn. Prices should remain relatively firm, despite improving fresh product availability from Europe and the US. SMP demand in Asian markets has slowed but is likely to revert to trend.

WHOLE MILK POWDER

China and Hong Kong helped the overall numbers look better and added the most trade in the month – up 69.4% YOY or 14,000t. YOY shipments to this key market have now increased in 11 of the last 12months for which data is available. Demand for milk powders remained resilient with the changes in China’s internal milk use.

CHEESE

The wide disparity in cheese prices should correct. EU commodity cheese values may be influenced by SMP/butter stream returns, but more milk will be diverted to increased plant capacity, which will keep a lid on values. EU exports again rose more than 8,000t YOY in September –the growth in the latest month was driven by stronger shipments to the Untied States but also South Korea.

BUTTER

Butterfat prices have remained steady with improved domestic EU seasonal demand. The EU balance sheet should improve but demand and supply growth will be closely aligned. Overall demand in developing markets remains price sensitive and may continue to pressure NZ prices. NZ exports of fats continued to shrink, but at a much slower rate –both AMF and butter were down YOY in September, 2% and 7% respectively. Meanwhile, the EU expanded butter exports in September by 74%, despite shipping butter at prices still higher than NZ.

WHEY

US exports continued to shrink, down 13% in September, while the EU grew shipments by 3.2%. Meanwhile, NZ trade rose 14% YOY in September – this followed three consecutive monthly falls and was driven by stronger sales into the North America market. US product remains competitive as prices have weakened since September while EU and Oceania prices remained steady.

By Dustin Boughton, Procurement, Maxum Foods – Your partner in dairy