Apart from the inevitable heavy correction in US cheese markets, global dairy markets remained relatively calm, as increased growth in milk supplies was matched by higher consumer demand and trade. Commodity fundamentals remain mixed across major producers, and regional factors continue to influence value directions.

Combined milk growth across major exporters will slow in the coming quarters, helped by dry conditions in southern hemisphere exporters and firmer feed costs.

Restrictions to limit the spread of COVID cases continues to support growth in retail demand while food service trade will remain weak. The risk of increased butterfat supplies through the northern winter with subdued festivities remains a risk – dependent on the extent of milk growth.

The adequacy of retail demand, kept markets balanced in Q2 and Q3, will be tested with dilution in income support for households driving more cautious discretionary spending in the dairy category. The absence of US government buying, rising milk supplies and a weak US$ will aid price-competitiveness of US protein and cheese, and limit gains in export markets for EU and NZ.

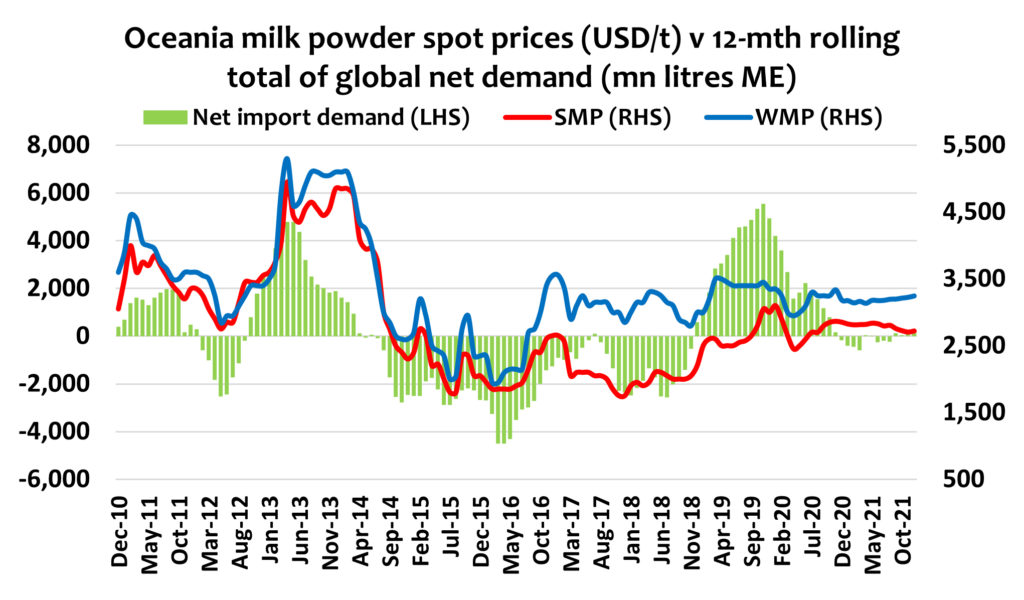

Export markets for commodities will remain patchy. The market will be supported by sustained Chinese demand for ingredients but there will be increased price-sensitivity with prospects of a slow recovery in SE Asia and MENA at firmer prices.

The spread of COVID-19 is out of the control of governments in most of the world and hope rests on the availability of vaccines which are projected to be in distribution in Q1-2021. While this (and prospects of more stimulus spending in the US and EU) has buoyed financial markets, the realistic scenarios and timelines for widespread availability and effectiveness vary widely – which see expectations of “controlling” COVID and returning to relatively normal patterns of life anywhere between late 2021 and well into 2023.

Skim Milk Powder

SMP prices in the US and EU have been in “sideways” mode for several weeks, despite the relatively tight balance sheets in those regions – compared to prior years.

Whole Milk Powder

WMP prices have stayed within a tight band for several months with persistent Chinese demand and higher NZ availability.

Cheese

After climbing through October, an expected major correction in US cheese values saw a drop in CME spot values in November as the availability of product improved and the influence of government programs evaporated. European cheddar values steadied in November, while NZ product values declined, but still trading at a (lesser) premium.

Butter

Butterfat trade may have finally gained some traction at lower prices, as it steadied and edged higher after a couple of months of big declines, as average shipped prices continued to fall.

Prices have lifted in the past couple of GDT events with the latest C2 pricing reaching US$4,000/t for the first time since April. Slower food service sales in developing markets is hampering expansion in demand, but in China where restrictions are gradually lifting, demand is surging.

Whey

Whey prices remain steady through November with NZ product trading at a premium, while the gap between US origin and EU narrowing.

By Dustin Boughton, Procurement Director, Maxum Foods – Your partner in dairy

Graph Reference: Fresh Agenda