Global dairy markets are expected to remain tight keeping commodity prices firm as milk growth is minimal and demand remains positive. The only changes in the settings in the past month have been tighter milk supplies with slower aggregate growth in output in the three major producers.

It is difficult to see any major disruption in the global landscape – other than a dramatic slowing in Chinese peak demand and slowing demand in domestic EU markets – that could dislodge these settings through the remainder of 2021 and H2-2022.

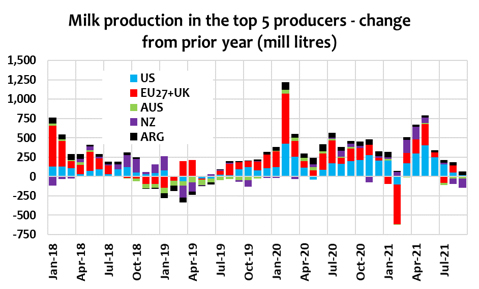

The lift in prices in recent months has been driven by the supply side and no much will change little before the 2022 spring flush in the EU and US, but even then, milk growth will be limited with weak farm margins. The rising cost pressures are impacting producers and already constraining milk output. US production has slowed with a faster cut in cow numbers due to exits in the southwest. Higher operating costs are also slowing milk yields as more expensive feed is cut. EU producers are feeling the same pain in costs but with already lower cow numbers.

NZ’s spring milk output has slowed with wet weather but should improve as the forecast warmer and drier pattern sticks, although cost pressures may also limit expansion.

Higher prices across the commodity spectrum will bring more caution in some consumer markets. Retail prices across all food categories will be pushed higher in coming months with the strong inflationary pressure from most inputs including energy, fuel, labour and packaging. Dairy prices will not stand out in that surge.

China’s demand through the peak shipping period into Q1-2022 remains critical in the short-term outlook. There may be some buffering of stocks of milk powders in that region with ongoing risks of logistical delays and new COVID risks. A slowing in milk powder trade won’t alter the tension in ingredients markets given the limits on the supply-side.

By Edwin Lloyd, General Manager Commercial, Maxum Foods – Your partner in dairy