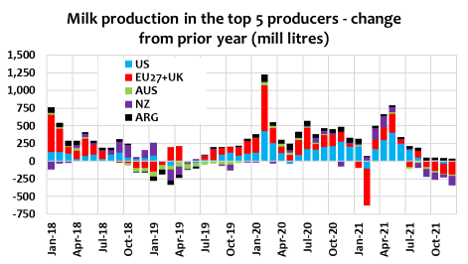

Global dairy commodity prices have reached historical highs and will remain under the strong influence of tight milk supplies, keeping commodity values at long-term highs, at least until the strength of the northern hemisphere spring flush is known. The EU’s contribution to any milk growth is under a cloud with high input costs and limited fertilizer supplies.

Commodity prices pushed higher in January-2022 as a weaker outlook for milk supplies in coming months due to the lack of NZ rainfall.

Fast-rising milk prices may restore margins for some producers, but cost pressures won’t ease quickly. Cow numbers in the US won’t steady and start to rise again until the 2nd half of the year, but herd reductions in the EU will likely persist in all cases other than Ireland.

Demand of dairy products has been supported by resilient domestic retail markets, while export activity, although disrupted due to logistical issues, has been close to pre-COVID levels.

Demand will be rationed at these high prices. Short-term trends may weaken with a likely pushback against strong prices where buyers have some coverage, but this is offset by a tightening supply base. China’s demand through the peak shipping period through Q1-2022 remains a critical feature of the outlook.

The spread of COVID infections remains a major challenge for the entire supply chain – reducing farm labour access, disruptions to factory operations and supply chains and limiting the ability to keep food service venues staffed. Consumers will continue to shun dining out in many regions, prolonging the uncertainty for the food service trade.

Weather will continue to play an important role as La Nina slowly recedes but leaving lingering dry conditions in NZ and South America.

By Edwin Lloyd, General Manager Commercial, Maxum Foods – Your partner in dairy

Graph Reference: Fresh Agenda