Dairy commodity prices in the EU remain firm after the spring milk flush, while weaker demand for dairy ingredients in China due to the strict COVID lockdowns has softened Oceania milk powder and fat prices.

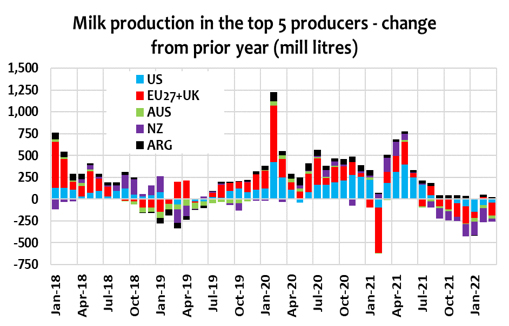

Supply-side constraints will remain a fixture in the outlook for at least the next half year as the effects of the Ukraine war will continue to drive high input costs (corn, grain and fertilizer). Milk prices continue to rise in Europe which will alleviate some of the pressure. Energy prices have receded in several regions as countries comply with Russia’s requirements to improve supplies but remain at extremes in others.

The weather outlook is not offering many prospects to improve milk supply, as Europe (already basking in a record hot spring) is forecast to have another warmer, drier summer, while the damage to pastures due to the poor finish to the NZ season may weaken the start of season in some key regions.

The constraints on EU milk output will keep protein and fat fundamentals firm, while the risk of weaker demand as buyers recoil from high prices is not expected to materially weaken commodity balance sheets. Higher food (and dairy) prices are reaching consumers but the potential damage to demand for dairy will be greater in butterfat rather than cheese.

The fundamentals also suggest a tighter US dairy market; milk output is constrained by weaker margins, sluggish recovery in the dairy herd and processor supply management, but there are mounting fears of softer cheese demand as households adjust to rising inflation. Lower milk availability for class IV uses in some regions will maintain protein and fat prices.

China’s zero-COVID restrictions will ease in coming weeks but a gradual return to normal mobility will take months. Damage to consumer spending (and confidence) and loaded supply chains will weaken short-term demand for imports.

With reduced exportable product, demand will inevitably be rationed in price-sensitive markets as consumers face rising food inflation.

Edwin Lloyd, Executive General Manager – Foods