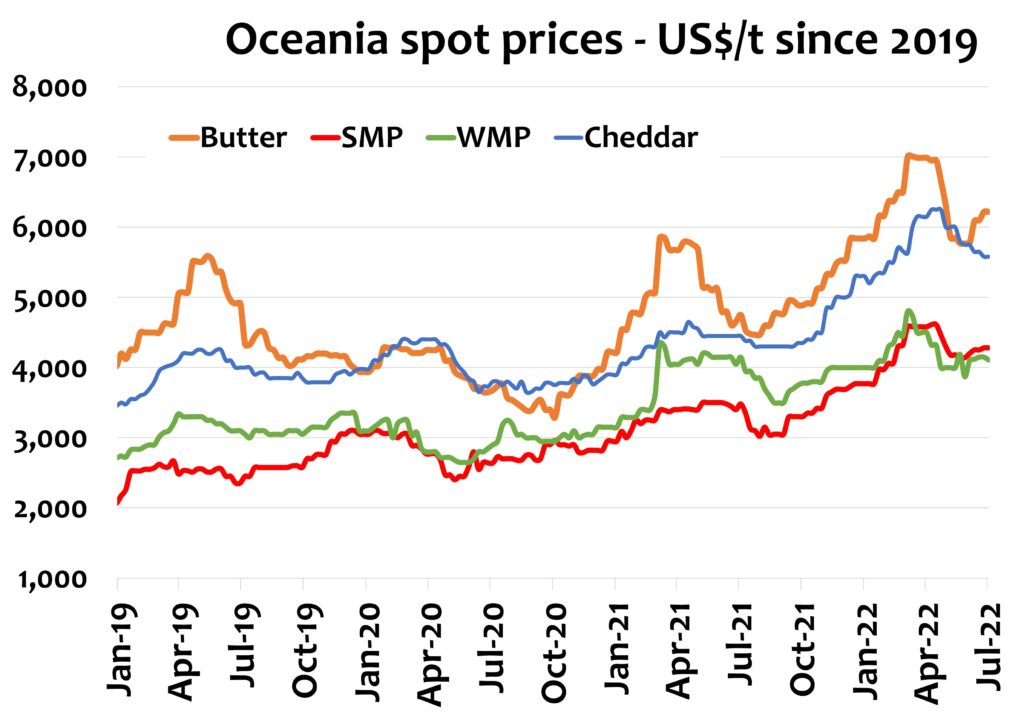

Supply-side fundamentals have changed very little since our June update, while commodity prices have eased across the board. This is partially due to some softer consumer demand, some buyer hesitancy, and the reduced activity that comes from a summer break for European traders.

These effects are compounding on the weaker demand for dairy ingredients in the short-term in China as its consumers build the confidence to resume “normal” life after strict COVID lockdowns.

The uncertainty of macro-economic settings and the rising fears of recession have produced big falls in grain and oil seed prices due to action of investment funds without much underlying change in crop conditions or weather.

The Oceania market is finely balanced. NZ milk output should improve a little in the coming season against the poor 2021/22 result but a further lift in milk prices won’t drive a stronger outcome as a poor start to the season, higher input costs and ongoing physical limits will constrain production.

Sustained demand from EU consumers, shifting focus to summer leisure and travel has recharged food service pipelines, which will continue to keep cheese supplies tight. Limited manufacturing milk and high energy costs will continue to shrink SMP and butter output.

US fundamentals are loosening as milk supply gradually improves with better farm margins while cow numbers slowly rebuild. Cheese will continue to take priority in milk use with better milk output in cheese-rich states, although demand is weakening as consumers feel the effects of inflation and spend less dining out.

Global trade has recently been mostly positive – especially from developing regions outside China. Demand remained solid for butterfat and protein in developing markets even as prices climbed to their recent peaks.

A mix of influences lie ahead – rising living costs present a risk to affordability but a return to meaningful tourist and business travel from their current seasonal lulls could ensure growth is sustained.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda