The world dairy market continues to provide a diverse set of conditions driving a disconnect in commodity values.

While tight milk and commodity availability in the EU will remain a strong influence, weaker demand in the US will keep cheese and protein prices under pressure. Significantly weaker demand from China and parts of Asia continue to weaken Oceania milk powder prices.

The slow recovery in Chinese import demand due to COVID restrictions remains a major influence over SMP and WMP prices. Indicators from the Chinese market do not yet provide support for a meaningful reversal of this situation, despite powder prices moving into a more attractive zone. Upcoming GDT events will provide critical signals.

The demand-side outlook is also more challenging with food inflation continuing to rise in most developing regions, pushed by the flow-on effects of elevated grain and energy prices.

The EU outlook remains the most uncertain. Milk collections have been resilient, aided by strong milk prices that will persist for the remainder of the year. Poor soil moisture remains a huge risk for crops and pasture fodder in some regions, while the uncertainty of the impact of EU-agreed gas rationing on powder drying will further threaten SMP and butter output.

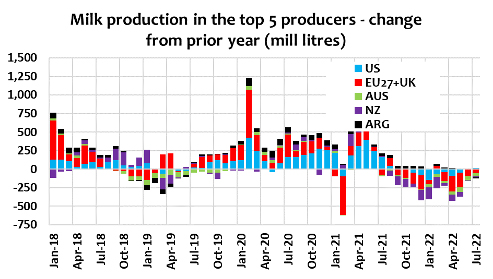

US market fundamentals remain weaker with the demand for cheese slowing. While milk supplies are expected to grow in the coming months, that is against a sharp reduction in cow numbers in Q3-2021. Weaker milk prices and elevated input prices are expected to keep producer margins under greater pressure through H2-2022. Wet weather is slowing the start of the NZ 2022-23 production season. The expected record milk prices won’t drive stronger milk output as higher input costs and labour shortages constrain production. Weaker demand from China and Sri Lanka leaves a large gap in WMP requirements and may provide some pressure to alter product mix in favour of SMP/butterfat – to what extent remains uncertain and may yet be swayed by short-term developments.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agend