The complexity of influences affecting the outlook for dairy commodities has become more deeply mired. Macro conditions have become more complex and uncertain as tensions around the Russia-Ukraine war escalate, the energy crisis in the EU worsens and global currencies respond to the efforts of central banks to manage inflation.

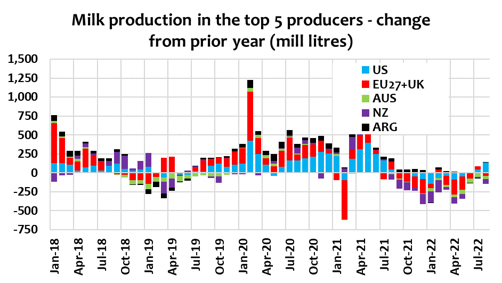

Supply-side fundamentals In Freshagenda’s analysis have changed with gradually improving milk availability in the EU, while the US is now firmly back in growth mode.

Uncertainty lingers in the EU with the likely damage to feed quality and reduced fertilizer application that could continue to weaken milk production and solids content in H1-2023. Extreme energy costs which are expected to remain a feature as EU countries wean off Russian gas dependence may discourage milk drying to limit SMP and butter production.

Oceania milk collections are in steep decline largely due to La Nina’s effect that has extended excessive wet conditions, as well as a cocktail of influences that are preventing any response to record milk prices.

Consumer spending on dairy is slowing in major developed markets as household cower from the effects of strong inflation and rising interest costs. Trading down is evident in spending, but retail data shows dairy volumes are already weaker.

In developing markets, rising food inflation and high dairy ingredient prices have also dented demand. There is still a lot of “wait and see” as buyers watch for signs that Chinese demand starts to return, and the EU situation becomes clearer.

After dominating dairy trade as China emerged from COVID in 2021, ongoing strict lockdowns to avoid the risk of new variants of the virus for unvaccinated populations continue to limit consumer mobility and weaken demand for dairy ingredients. Macro indicators suggest a weak spending recovery while domestic milk supplies remain adequate to stifle import demand for WMP.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view a PDF of this release, click here.