The outlook for dairy market fundamentals continued to be mixed at the end of October 2022.

Most of the focus is on the demand side with China sticking with a strict COVID policy until March 2023. Buyer caution persists in developing regions with the uncertain effect of inflation on dairy spending. EU appears to have a weaker domestic market in cheese and butterfat, while the US cheese market remains resilient, shifting to lower-priced lines and to a stronger emphasis on mozzarella.

Supply-side fundamentals are mixed. While the US and EU are both growing milk, momentum is far from convincing. The US continued to post good growth over 2021, but the outlook is weaker into 2023, with cow numbers declining, and projected margins weaker. Feed markets are likely to firm with poor crop yields and renewed threats to Black Sea trade.

The EU is enjoying some seasonal milk growth with better conditions also against weak prior year numbers, but potential headwinds are ahead in H1-2023. Milk prices will soften while fragile feed quality and likely weaker spring pasture growth (with limited fertilizer supplies) could easily pull milk output lower.

The EU’s energy situation is a little less dire for the winter ahead with energy prices falling significantly in October, but energy futures prices remain prohibitive. The situation is uncertain as EU members scramble to implement measures to ensure security of supply and cap prices.

Oceania milk supplies are only getting worse with the wet conditions on the North Island now likely to drag peak NZ output down by around 4-5%. Australia’s export availability is also diminishing with persistent rain and flooding affecting producers in several regions. Milk output is expected to fall 4-5% over the current season.

China’s eventual recovery from COVID restrictions remains a key influence in coming months. Milk availability appears ample there according to price and cost indicators, while demand in food service and convenience will continue to suffer from lower consumer mobility.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

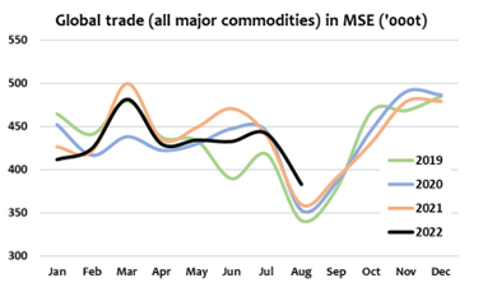

Graph Reference: Fresh Agenda

To view a PDF of this release, click here.