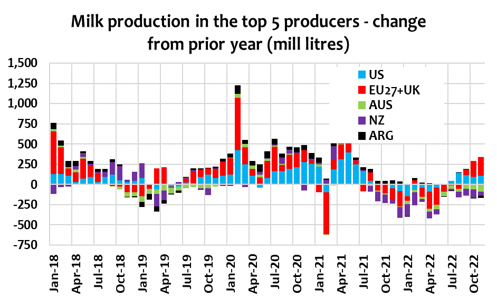

Market fundamentals in the outlook remain complex with many moving parts over the next two quarters. Milk supply growth in major (top 5) exporting producers is expected to grow less than 1% in H1-2023 – although there are still many variables in play that could easily shift that either way by a further 1%. The net outcome will keep things even in the short-term but at a regional commodity level, we’ll still see some diverse effects.

While the delay to the restart of demand in China, which will affect WMP and other products in different ways, is a major uncertainty, the EU continues to be the dominant influence on global supply-side fundamentals. Improved milk production has improved butter and SMP availability, while export demand for SMP remains weak and domestic cheese and butter demand has slowed with high prices.

While EU milk growth should slow in winter, uncertainties associated with feed availability (and quality) and the effect of lower fertiliser use make it hard to predict milk production through Q2-2023. By then milk prices may have come back to earth, which could combine to slow milk growth further.

US fundamentals could get a little tighter as milk output will come under greater pressure with skinnier operating margins and higher cost barriers to herd expansion. Filling cheese plants will continue to be a priority in cheese-rich states, although cheese demand may slow. So far, the pressure on US households has only shifted the mix of cheese output to match demand, while export opportunities in cheese may soak up some available supplies.

Regional US milk availability will influence shifts in product mix, but the southwest with highest SMP output faces risks of more farm exits with the worsening water and feed availability.

NZ milk output could improve through summer with the weakening La Nina, while late season milk will grow against weak 2022 comparatives. The balancing act for WMP producers will continue, but prospects of a rapid recovery in WMP demand from China look unlikely.

Meanwhile Australian wholesale prices are increasingly disconnected from global fundamentals as the implosion in milk production reduces available product. Cheese and butterfat prices remain well above NZ prices and should maintain immunity through H1-2023.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view a PDF of this release, click here.