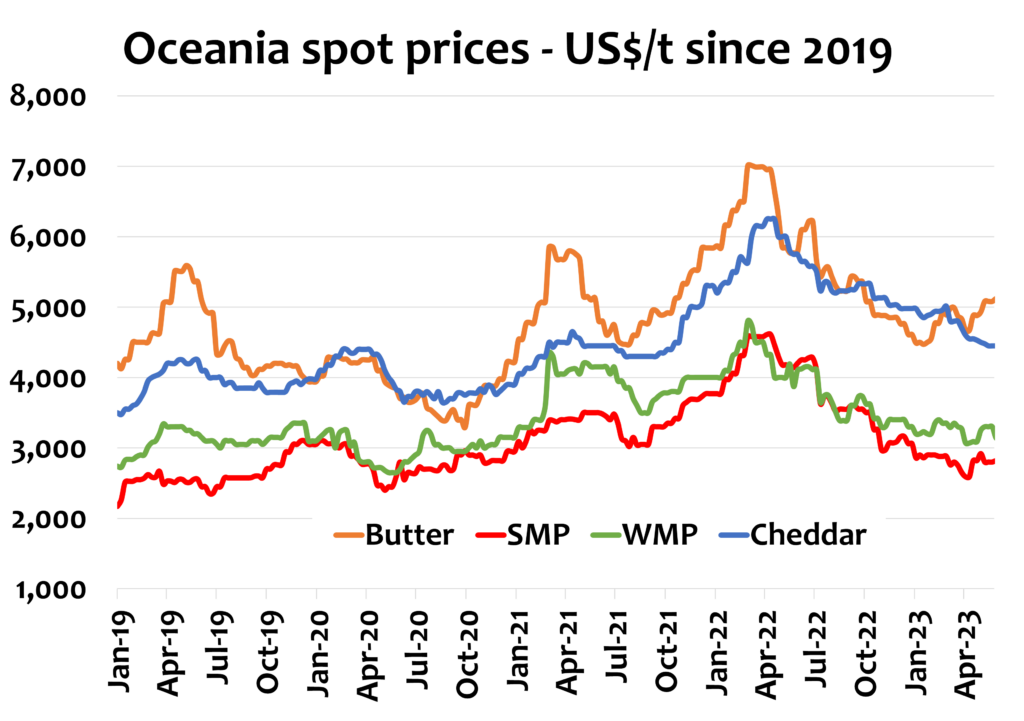

Mounting supply side pressures are gradually improving global dairy market fundamentals. There are some early signals of improving demand in export markets, although some new affordability challenges are emerging.

In the short-term, commodity prices in the EU and Oceania are at the risk of weakening further through the typically quiet summer period in Europe, meanwhile seasonal increase in GDT product availability is being met by weak Asian and Chinese demand.

But something will give soon. Milk output will inevitably be curbed by harsher weather and weak producer margins, luring buyers back to cover requirements further into 2024. Global dairy trade has improved in overall terms but is still relatively thin and it is not convincing enough to counter a weak EU market still grappling with high food inflation.

The SMP demand recovery is sluggish with consumption in EU processed food categories slowly recovering. Reduced affordability and lower food service patronage in Southeast Asia has kept buyers cautious, and demand won’t simply bounce back because it is below trend. Consumer spending is impaired, and food inflation will linger if El Nino hits rice and palm oil crops as is threatened in coming months.

There is little change in the situation in China with the long-awaited recovery in powder and fat demand still not there yet. The erosion of milk output due to weak margins and gradual recovery in UHT milk demand will eventually slow local WMP output. But with the seasonal lift in NZ availability, a strong recovery in domestic use of powder is needed in China to justify higher imports, despite the import cost advantage.

The juggling act for NZ producers will continue, but WMP demand is improving in the key NZ markets, justifying an increase in WMP output. The brakes on US milk output are suddenly more apparent with latest data showing deeper cuts in cow numbers and no gains in yield, which recently gave the spot market a wake-up call. There is only one way milk output can go from here and with the US economy still firing, cheese and fat markets are slowly tightening.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda