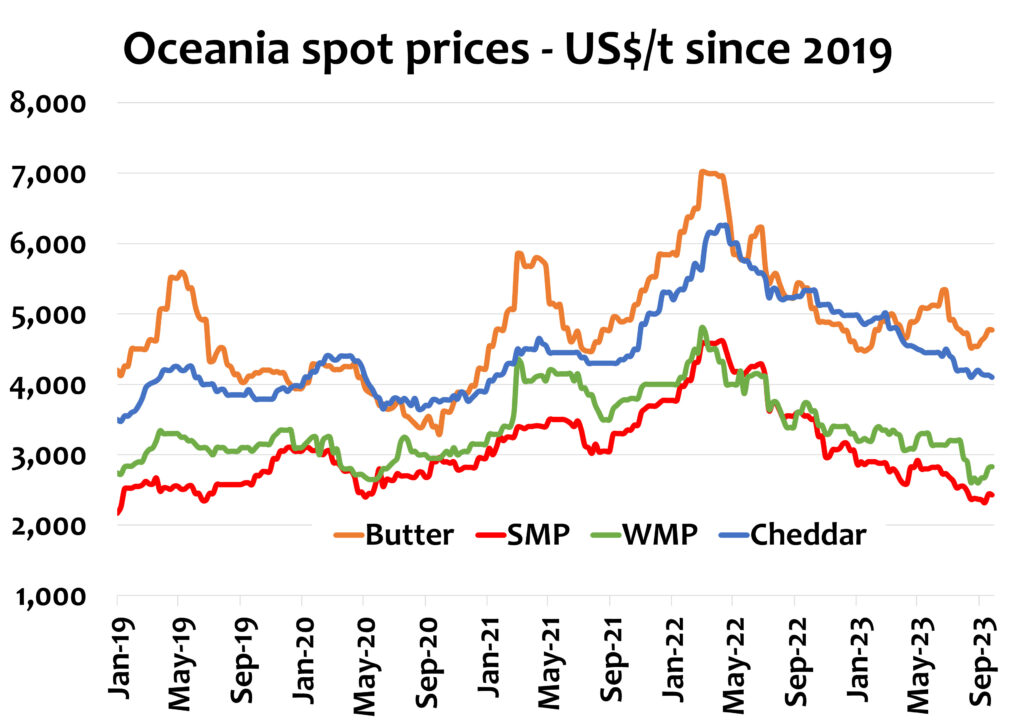

There is growing belief that the low point of this commodity price cycle is in the rearview mirror. Global market fundamentals are improving but the landscape is mixed. Milk output from the top 5 producers is expected to be flat in Q4-2023 and through H1-2024 (leap-year adjusted).

Tighter milk and cream supplies are readily apparent in the EU as milk supply slows and demand for butter and cheese improve. This is flushing out buyers keen to cover requirements near the bottom of the market, which becomes self-fulfilling. While butter and cheese fundamentals are improving, protein remains fragile, with ongoing weak demand from the EU’s internal market and underwhelming buying from Asia, although there is evidence of price firming as processors sell forward. Ironically, that market region will continue to drive the price action in SMP on GDT.

There are challenges ahead for Oceania milk output with an erratic early spring in New Zealand which is likely to deliver a weaker production peak. Despite that, there remains a fine balance between WMP output and China’s import demand.

While China’s domestic market is slowly recovering – strongly in imports of some products – the internal milk market remains oversupplied, and it has built a horde of SMP. There is little evidence that the slow recovery in UHT milk and ingredient demand is sufficient to bite into milk availability – and lift WMP import demand. For now, WMP stocks remain elevated.

Demand from other export markets remains mixed. There is now an expectation that SE Asian demand won’t improve until H1-2024 with ingredients, fats and cheese trade still weak. Meanwhile, opportunistic MENA and Mexican buyers have taken advantage.

The US is a self-contained market influenced by external protein and cheese prices but is again showing divergent product values that can’t be explained by fundamentals. Cheese prices have been volatile, illustrating the fragile market balance which is exposed to the opening and closing of export windows. Milk will start to grow before too long with better margins as cheese demand falters. Meanwhile, the tightening of bulk butter supplies ahead of the seasonal surge in demand will again keep prices high late into Q4-2023.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.