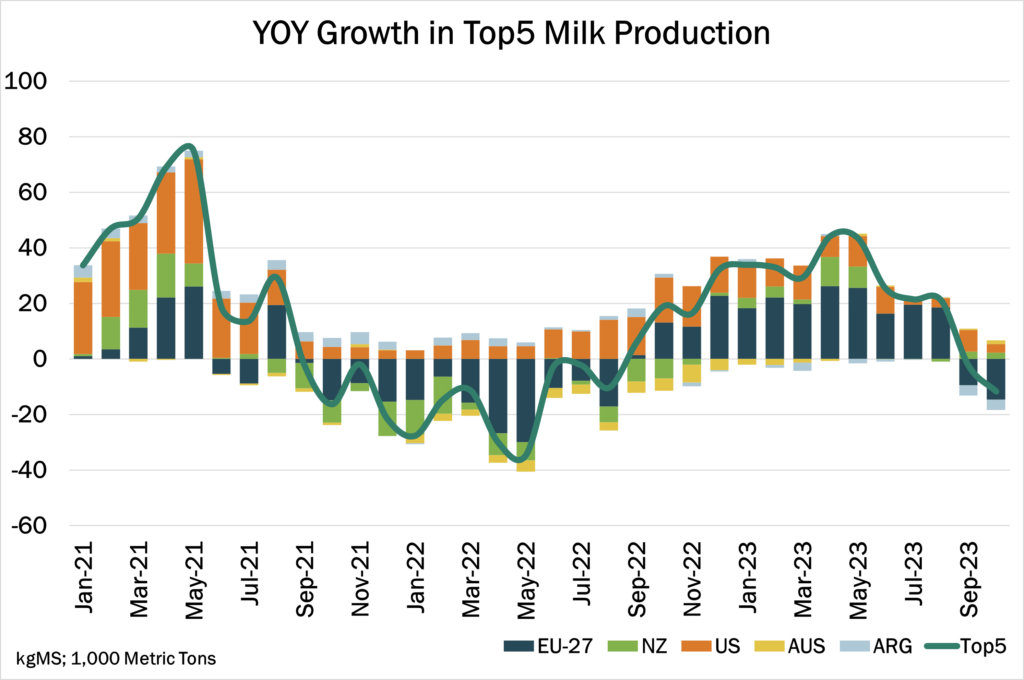

Little has changed in terms of the supply and demand fundamentals in the outlook. Milk supplies continue to slow in the EU and US, stocks generally tightened as 2023 closed, but demand-side weakness remains the major challenge.

The EU market was mixed at year-end. Ingredient and butter stocks tightened as good demand for fresh cream and cheese took priority, but improvements in milk supply and the uncertainty of early 2024 demand drove weaker cheese and ingredient prices.

The EU milk supply outlook has varying influences – an outbreak of blue-tongue disease poses an ongoing threat while producer margins are favorable and warm late winter and spring are forecast.

The US market will suffer short-term volatility as milk supply slightly contracts over H1-2024. Softening domestic demand and insufficient export activity could keep short-term pricing under pressure but cheese supplies will gradually tighten. New cheese capacity won’t drive any growth in milk collections until late in 2024.

While SMP availability has reduced in the EU and US, the Oceania market will continue to drive price action in the short-term, with no pressure on availability and still weak export demand from Asia. A slowing in NZ output is expected as El Nino’s influence builds, which may alter ingredient and butterfat supplies if export demand recovers.

There is little change to the main themes in trade. China’s sluggish market is well-supplied (with cheese the only bright spot), while there have been some improvements in SE Asian trade. The scrap over contestable cheese markets remains critical to marginal cheese availability and available prices each of the big three producers.

There is once again pervasive belief in the EU and US that short-term price weakness should attract buyers, a story we heard a few times through the fluttering rallies in 2023. Let’s see if that rinses and repeats in 2024.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.