Global Dairy Commodity Update April 2024

Global fundamentals have weakened since our last update. Major powder ingredient and cheese markets have drifted down with worsening demand signals and improving EU milk output.

EU production is seasonally building and likely to grow year-on-year (once the ground dries out) with favorable spring weather, feed input costs and milk prices.

The weak demand side of the dairy complex appears hard to shake. Large volumes of powder were shipped (especially out of NZ) as buyers took advantage of attractive prices in late 2023 and early 2024. However, the lift in buying is unlikely to continue with headwinds in SE Asia and China and the large stock-build in the Middle East.

Global trade increased 7.7% year-on-year in Milk Solids Equivalents (MSE) terms in January and was 4.4% higher over the last quarter.

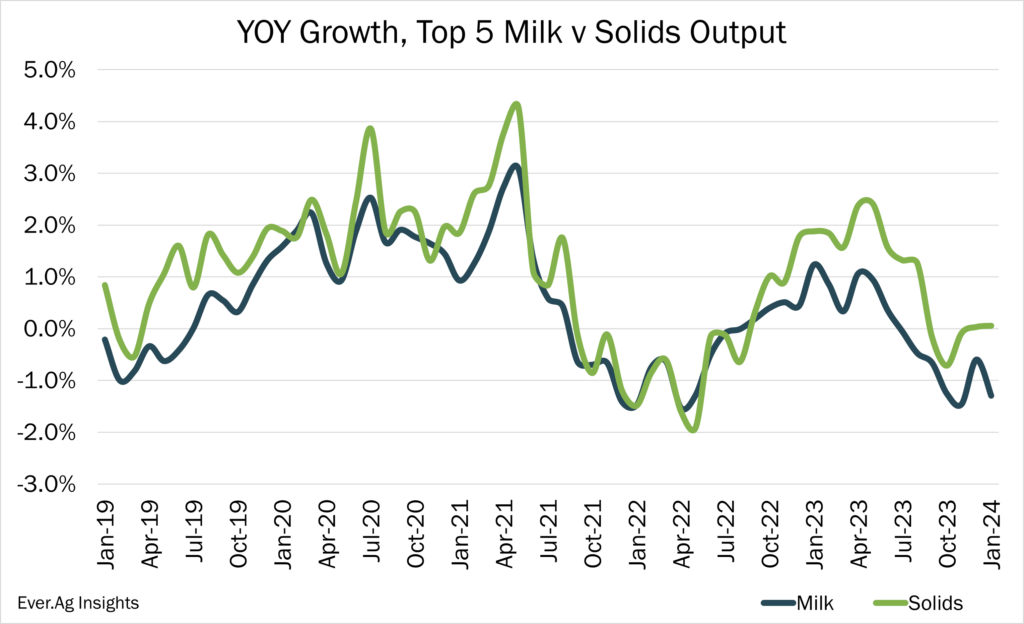

In the past year, trade was only 0.8% above the prior year, which reflected the minimal growth in global milk supplies and export availability.

Meanwhile domestic ingredient use in the EU and US will remain under pressure subdued end-use demand, including the challenges ahead in the chocolate market, with the significant increase in cost of cocoa.

Good demand and limited supplies ensure EU and US butter, and Hi-Protein Whey remain the few bright spots.

The US cheese market remains weak with pressure on consumer spending, while exporters have lost major market shares in head-to-head contests with EU suppliers.

The prospect of additional cheese capacity due to come online in late 2024 is a major watch-out, given languid demand and limits on milk supply. The effects of these major influences on fundamentals across the commodity spectrum continue to vary by product and region.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.