Global Dairy Commodity Update June 2024

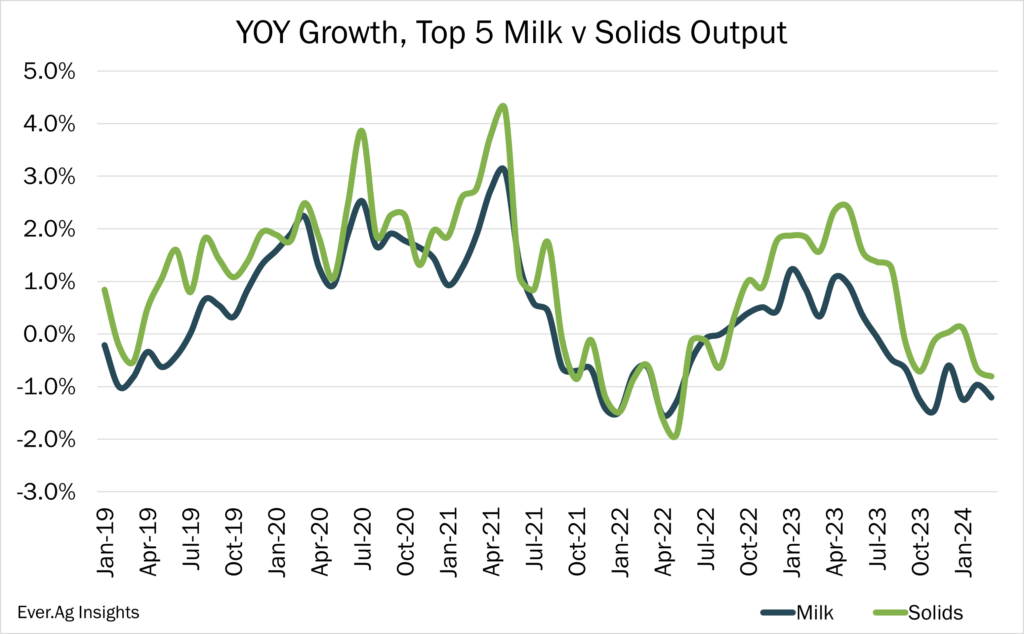

Global fundamentals have improved since our last update, mostly reflecting supply-side factors.

Weaker than expected EU milk solids production and tight cream supplies pushed the butter market sharply higher, supporting the lift in Oceania butterfat and EU cheese prices.

It’s likely to be several months before the EU butterfat fundamentals weaken. There may be some pushback in EU domestic demand, but a further threat may come from higher availability from NZ when butterfat availability increases seasonally in Oceania from September onwards.

This will test the affordability of high butterfat prices in the Asia and MENA markets and Europe could then become a more viable alternative market for NZ exporters, with lower tariffs under the NZ-EU and NZ-UK FTAs.

The strong lift in butterfat prices will continue to burn off demand in price-sensitive export markets, facing affordability challenges due to still rising prices generally, and a stronger US dollar.

Meanwhile, weak demand and prospect of sustained higher NZ supply will continue to limit the upside for SMP in the EU and US, despite low stocks in both these major producers. Ingredient demand in food processing continues to lag in most domestic markets.

While trade in developing market regions outside of China increased as buyers restocked at lower prices in Q1-24, increased ingredient prices will test viability of this trade in coming months.

The US cheese market remains in focus given the importance of marginal trade to the big three export regions. The rally in US cheese prices stalled, and while there is limited growth in milk output, ongoing pressures on consumer spending and expanding cheese capacity may put global market prices under pressure later in 2024 and into H1-25.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.