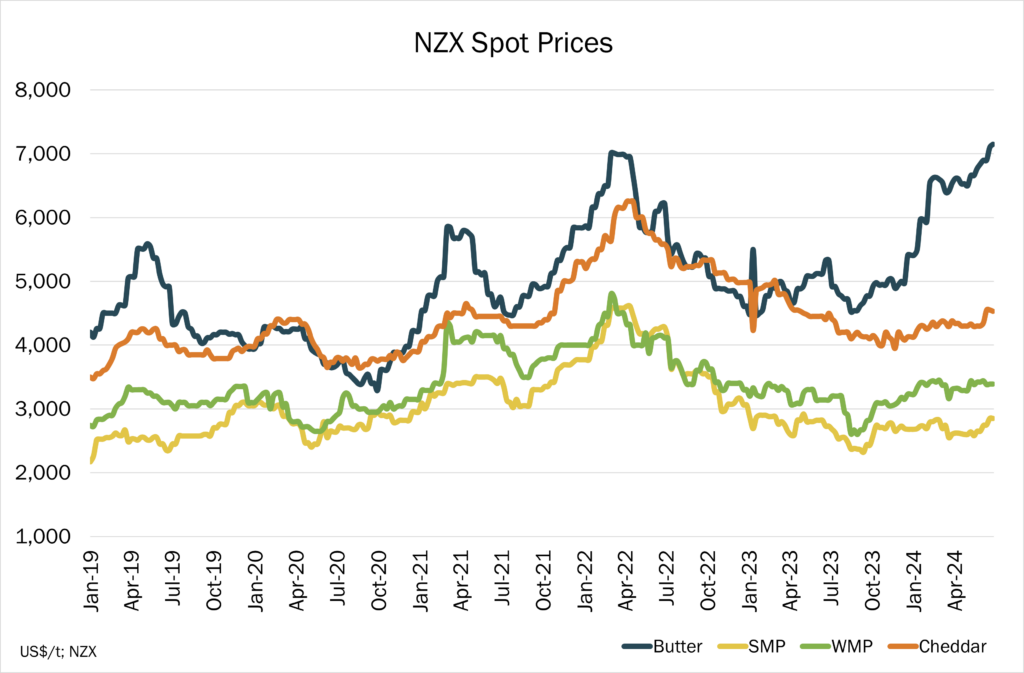

Global Dairy Commodity Update July 2024

Global fundamentals remain mixed across products and major producing regions, but there are developments in supply and demand that have altered the outlook.

Global trade declined 1.5% year-on-year in Milk Solids Equivalents (MSE) terms in April but was 3.2% higher in the last quarter. The April decline was mostly due to weaker trade for major milk powders and fats, while cheese and dry whey trade expanded significantly.

The seasonal firming in the EU fat market will likely come in Q3-2024, but the supply side is uncertain. Milk output will gradually improve across the region as warm weather sets in, but rainfall in the short-term remains widespread and the ongoing effect of excess moisture on forage quality and milk solids output is uncertain.

Tighter cream supplies due to both demand and supply effects will stabilize the butter market. Elevated prices may burn off some demand but the larger threat in Q4 from seasonally higher NZ availability lingers.

The durability of global fat demand (already weaker at higher prices) as NZ output builds will have a critical influence on the EU market.

Sluggish demand and sustained higher NZ supply will continue to limit the upside for SMP, despite low EU and US stocks.

While trade in developing market regions outside China increased as buyers restocked, increasing ingredient prices will test viability of trade (especially in MENA) in coming months.

The US cheese market remains important due to the contest between the big three producers. Tighter stocks, lower cheddar output, and improving demand should be supportive.

The US production outlook is uncertain despite cheese capacity additions. While central region milk solids output is growing, supply faces headwinds due to limited heifers and poor margins.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.