Global Dairy Commodity Update August 2024

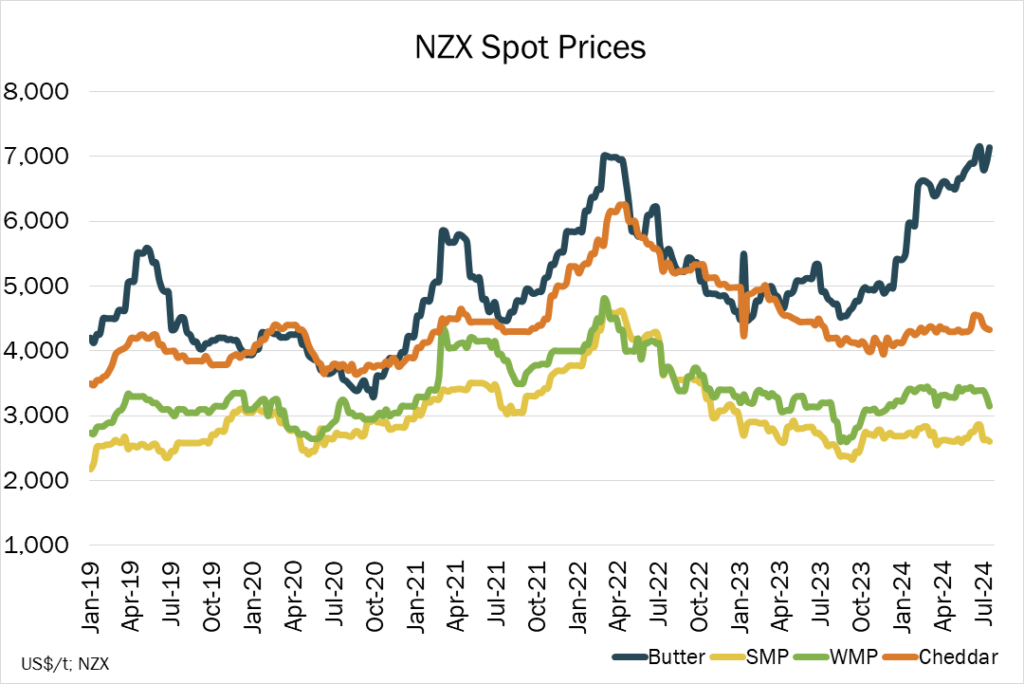

Global fundamentals are mixed across product categories and major producing regions.

Weather continues to create supply challenges in Europe. Excessive wet and summer heat are impacting milk solids output in the short-term, limiting butterfat supplies, while summer cream requirements and steady cheese demand are constraining SMP and butter output.

Tighter butterfat supplies will sustain a firm EU butter market well into Q3-2024, with the developing risks of high prices burning off some demand, as well as the prospect of NZ imports at reduced tariff rates. The durability of global demand for butterfat in developing regions as NZ output builds through spring will also influence the EU market.

Milk output through the peak of the NZ season is in the balance with uncertainty due to a shift to a La Niña climatic pattern, and the impact of recent dry conditions reducing soil moisture.

There is little change expected in the NZ product mix (other than within milk protein products) as the outlook for China’s WMP import demand remains weak. The impact of meaningful measures in China to limit milk output (as recently announced) may alter that in later in 2024. There is ample precedent for such measures in the past, but this could easily be the catalyst for change in their supply chain.

While US and EU SMP stocks are relatively tight, sluggish demand and sustained higher NZ supply will continue to limit the upside for SMP. Increased trade earlier in the year as buyers restocked, and the resultant increase in dairy and non-dairy ingredient prices will continue to challenge a demand revival in coming months.

The US production outlook is mixed, with milk solids output continuing to expand in central regions as new cheese capacity additions come online. Improving margins will improve the prospects for output growth in H2-2024, offering better payback on herd replacements. Improvement in US cheese demand is critical to keep the market in balance, as some macro factors suggest threats to consumer spending.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda