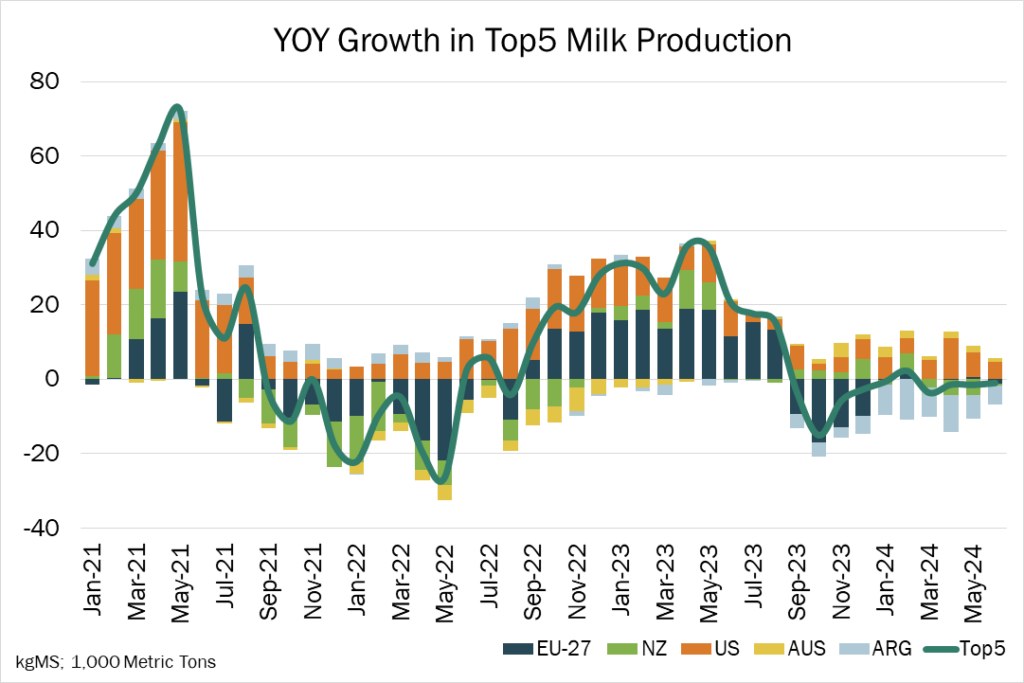

Global Dairy Commodity Update September 2024

Acute butterfat shortages in the EU due to a perfect storm of supply and demand impacts have quickly escalated to dominate global fundamentals. The convergence of reduced milk fat output, a firm cheese market and summer cream demand are exacerbated by buyers coming back to market with uncovered short-term needs. The recent spread of a debilitating animal disease is further impacting milk output.

The effects have quickly pushed butter and cheese prices to unsustainably high levels. There are several scenarios as to how and when this might unravel, but there is little belief that a pushback on high prices, a milk supply response to improving margins and cooler weather will be enough to quickly loosen the supply chain. The prospect of lower-priced NZ butterfat with significant price advantages into Europe, particularly the UK, could also threaten high EU prices.

Milk powders are partially caught in this crunch, as WMP values are supported by escalating butterfat prices and improving demand in developing markets. Despite tight EU and US supplies, SMP has been insulated with weak demand and abundant NZ supply.

The US is also in a supply-side bind with limits on growth due to scarce young stock and weak margins, while cheese demand has been lethargic.

US farm margins will improve, but physical constraints could ensure a slow supply response, while further demand-side headwinds threaten. New cheese plants rolling out in coming months will likely be mostly filled by competing for milk and relocation of herds rather than new growth.

NZ is starting a new season with good conditions, stronger farmgate prices and improved confidence.

In Australia, cheese stocks continue to overhang the wholesale market, but increased export success is helping reduce the surplus. Domestic prices are below import parity with the influence of tight milk supplies and strong butterfat prices on EU and US cheese prices. Australia’s monthly cheese imports remained weaker than the prior year, falling 13% YOY in H1-2024. Butterfat imports were down 24% in that period, with rising world prices unattractive to local buyers.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.