Global Dairy Commodity Update October 2024

The tight butterfat situation in the EU remains a dominant influence on global fundamentals. While typical EU market seasonality would suggest cream availability will improve in November-December as milk output seasonally rises and fresh demand softens, butter supplies will remain tight, aided by persistent demand for cheese.

Bluetongue infections continue to impact milk output in northwest Europe. There is uncertainty of the duration and severity of the production impact, with diverse controls and uptake of vaccines.

There seems little belief (based on futures and actual trades) that the market will go down prior to December, even with a combination of a consumer pushback on prices (as yet untested), improved milk supply with rising farm margins, cooling cream demand, and lower-cost NZ butterfat imports.

Growth in milk output is rising in other regions. The real prospect of stronger NZ peak seasonal milk output is keeping SMP prices in check, despite tight EU and US supplies. NZ’s growth remains heavily weather-dependent, but milk prices have also firmed to spur confidence.

China’s efforts to stimulate spending and, specifically, demand for milk and rebalance the supply chain will be interesting to watch for the potential impact on ingredient imports.

US milk solids output, already rising 1.5 to 2% YOY, should improve with attractive margins, strongest in regions with new cheese capacity.

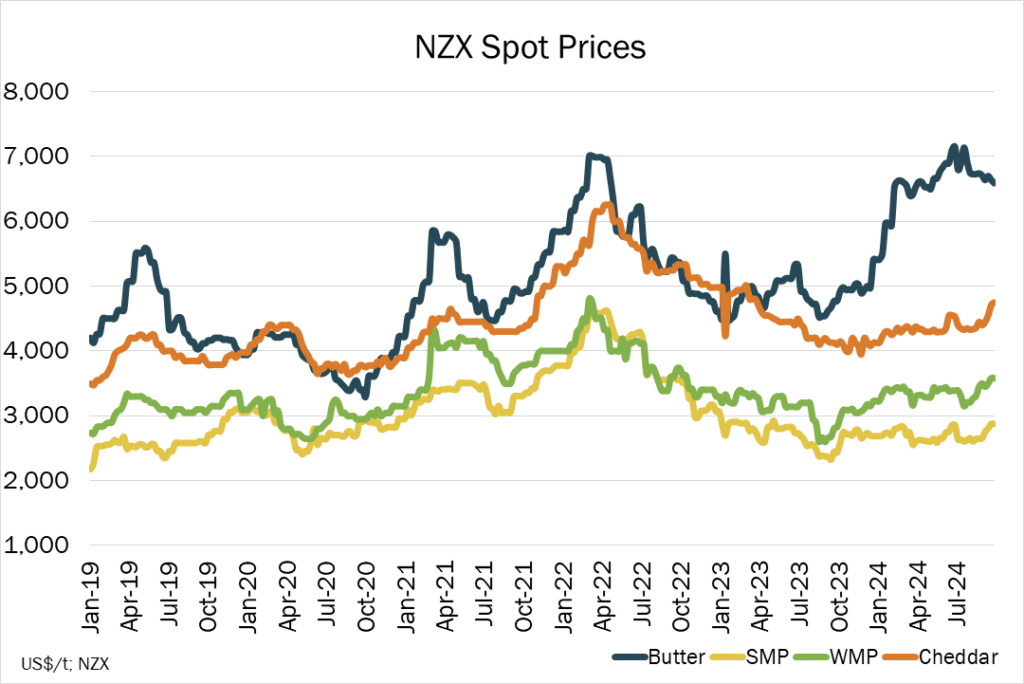

Cheese prices will gradually relax as cheddar supply improves as new plants fill. Meanwhile the abundance of butter stocks and improving cream supply will keep pressure on butter prices which recently sharply corrected. Cheese exports will be important to the US cheese balance sheet in H1-2025, with a projected advantage (in forward prices) in that period without drastic change in the EU market. The contest in cheese markets will be keen with NZ also seeking to lift cheese output, targeting Australia and other regional markets, to help reduce reliance on SMP & fats in its product mix.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.