Global Dairy Commodity Update May 2025

The complexity of global market conditions has been amplified by the uncertainty as to how the aggressive protectionist US trade policy plays out in coming weeks and months.

While the duration and extent of tariff measures, including any retaliatory actions, are impossible to predict, there are evolving impacts on trade flows, global shipping, consumer confidence and the developing economies dependent on China’s economy.

EU milk output faces headwinds as the blue tongue virus is expected to re-emerge in warm weather. Production conditions have improved, and farm margins are favorable (helped by strong beef prices), but dry conditions may impact feed supplies. Consumer demand has remained stable at elevated prices, but exports are less competitive against cheap US product.

The US market faces worsening oversupply as consumer demand will have further headwinds if inflation revives. Milk and cheese output are building, slower than expected, but will continue to drive short-term price volatility.

The cheapest cheese and butterfat on the global market will find increased demand in export “swing markets”, while the stability of cheese trade with Mexico is crucial. The re-direction of whey and carbohydrate commodities away from China will alter production and trade flows.

Drought conditions have been alleviated in NZ ahead of the new season, but continued rain is critical. While milk output may slow, the product mix flexibility in response to shifting market conditions across commodities remains important.

Australian milk output will remain under pressure due to dry conditions in southern regions. Milk prices in the 2025/26 season will increase to near A$9.00/kg for major manufacturers, reflecting firm cheese and butterfat prices. Cheese imports increased in March to service commodity segments of retail and food service.

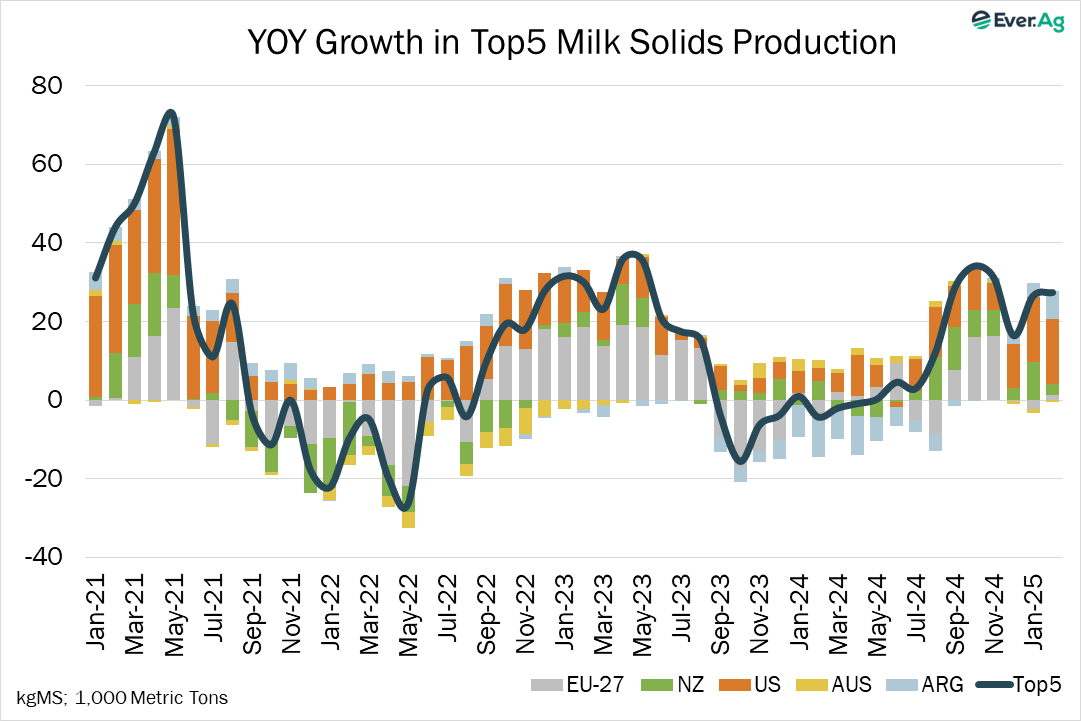

It is estimated global trade grew 2.6% YOY (leap year-adjusted) in Milk Solids Equivalents (MSE) terms in February, which lifted three-month trade by 5.5%. In rolling annual terms, trade was up 1.4% YOY, continuing a steadily improving trend since the lowest recent mark in March 2023.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.