Global Dairy Commodity Update June 2025

Global market fundamentals have improved overall but are still strongly influenced by tight EU milk and butterfat supplies. While elevated tariffs threatened by the US are on pause, the uncertain duration and extent of trade disruptions to the dairy complex and the wider global economy feeds caution. Meanwhile large shifts in US fiscal policy and geopolitical agendas will impact financial and commodity markets.

There are several variables influencing the outlook for dairy markets. EU milk output faces headwinds from low soil moisture and animal disease. The expected lift in milk and cream supplies isn’t materializing, supporting butterfat and cheese prices. There is a watch-out for potential improvement in conditions due to impending rain events.

Production conditions are improving in NZ ahead of the new season. With little change in China’s WMP demand, NZ’s product mix flexibility in response to shifting market conditions and opportunities remains vital. The exposure to price-sensitive MENA and Asian butterfat markets remains a risk.

US market remains well-supplied, but fundamentals have improved. The cream glut is quickly evaporating. While technical factors and slower-than-expected filling of new plants have recently been supportive of cheese prices, a sustained recovery appears fragile.

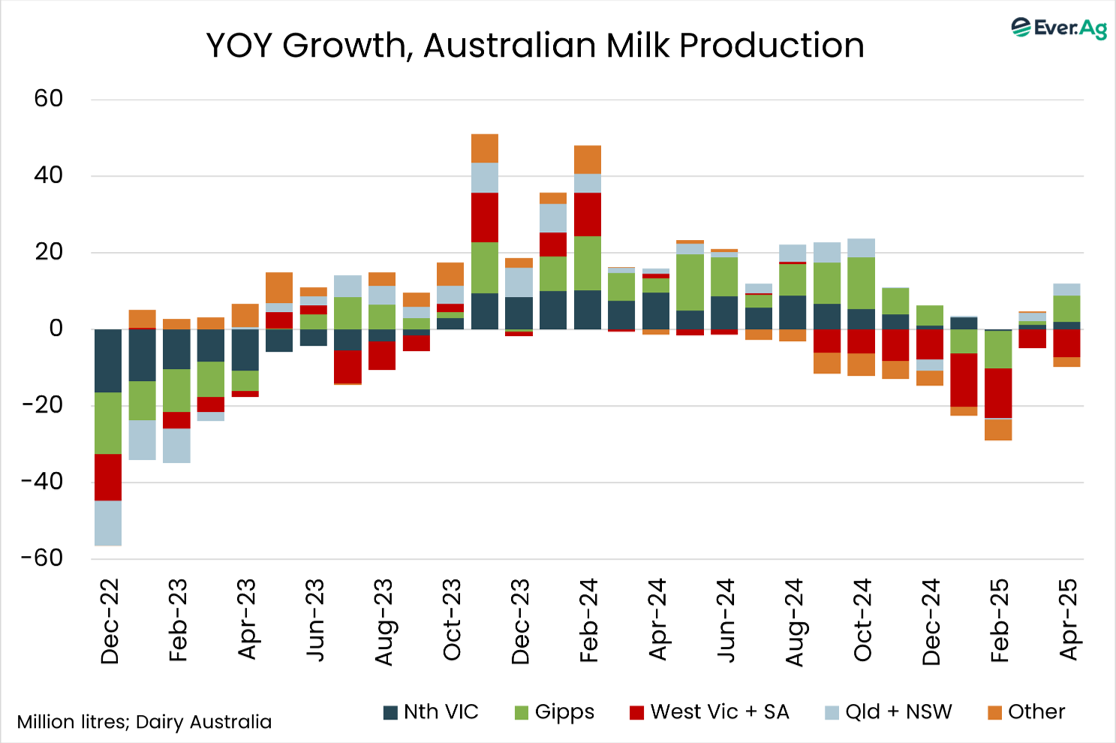

Australian milk output in southern regions will worsen with severe drought, despite resilient output through April. Culling increased sharply in May and will deplete herd numbers into the coming season.

Floods impacting NSW will also cut local output, resulting in more milk pulled from Victoria to service northern fresh markets. Our production outlook has been cut to be down 2% in 2025/26, with a lower spring peak given the reduction in the herd.

Southern region milk prices for the full 2025-26 season will in our view be in the $9.30-9.50/kgms range but opening prices will be cautious given global uncertainties, at around $9/kgms. Rising farm costs will trim margins for drought-affected producers, with surging forage prices.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.