Global Dairy Commodity Update April 2025

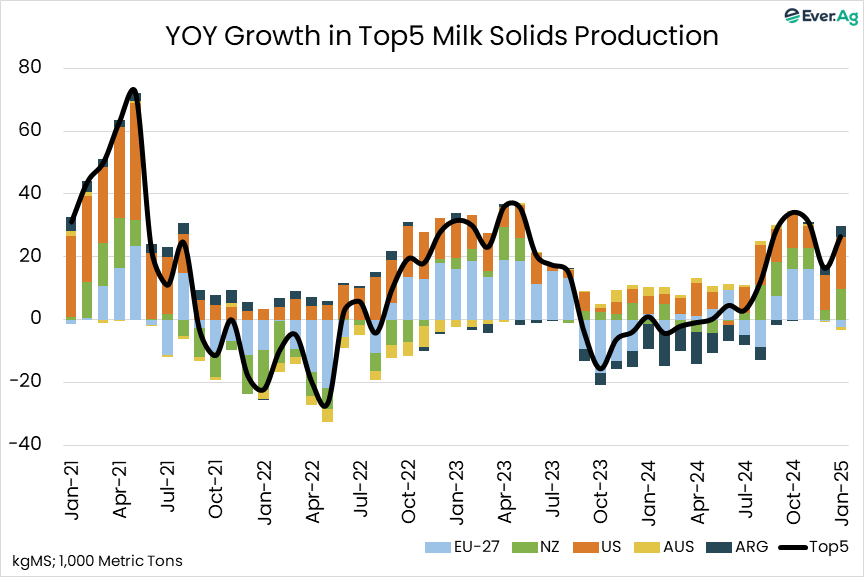

Major exporters face diverse market and production conditions with geopolitical tensions, new US tariffs and animal disease increasing the complexity.

EU milk supplies face headwinds with falling cow numbers, and the now-dormant blue tongue virus expected to re-emerge in warm weather. Pasture conditions are varied, while a dry start to spring benefits some producers, high cow prices may tempt producers to reduce their herds.

Late-season drought slowed NZ output and may also limit milk supply at the start of next season. A shift of milk use to chase high-protein demand has limited exposure to the fragile SMP market, while abundant AMF may find sufficient traction at a heavy discount to butter in price-sensitive developing markets.

The recent revisions in US herd numbers suggest “the cows are there” and hence stronger milk and cheese output through 2025 than previously expected. The gradual filling of new plant capacity will ensure ongoing cheese market volatility.

Fast recovery in US domestic demand seems unlikely with cratering consumer confidence (which won’t be helped if new tariffs are lasting and lift inflation), making exports to contested markets crucial. The stability of the EU butterfat market, and competitiveness of NZ ingredient stream returns will influence cheese market dynamics.

Milk output in southern regions is slowing rapidly as hot and dry conditions affect output in Western Victoria and Tasmania, reducing collections more than 10% YOY combined in Feb-2025.

Our full season outlook worsened to be down 1.6% in milk solids (H1-25 down 2.9%), with the prospect of increased early drying-off and farm exits. Cheese and butterfat imports will grow with slowing output.

Small late-season milk price step-ups have been announced, but limited further uplifts are expected. Milk prices for the 2025-26 season are likely to be in the $9-9.50/kg range based on the outlook for product values.

Australian exports rose 42% YOY in January in milk solids equivalent terms (MSE) and have increased YOY in every month since December 2023.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.