The outlook for market fundamentals has further tightened on the supply side in the past month with peak production in NZ remaining weaker than expected and continued downward pressure on EU milk production. The rapid slowing in US herd numbers eased a little in latest data for October while cash margins will improve slightly which may stabilize output.

Total global milk output is expected to stay in decline for at least the first quarter of 2022.

The outlook for milk collections won’t get better unless excellent pasture conditions develop in the European spring, while US milk will likely remain slightly below the prior year. In the meantime, farm input cost pressures will remain intense through winter and likely have a further impact on the spring flush in Europe, as farmers protect cashflows by limiting expensive fertilizer applications. High beef prices meanwhile will still be tempting for quick cash relief.

Weather will also play an important part in NZ possibly lifting pasture growth with warmer summer weather. A near-NZ$9/kg milk price is now widely expected which will ensure a strong focus on per-cow yields using bought in feed.

On the demand side, there has been some weakening in EU fat prices post-festival buying but domestic demand is good. Uncertainty for the food service market lingers in some regions but retail has been more than supportive.

China’s demand through the peak shipping period into Q1-2022 remains critical but indicators from that market do not suggest a rapid weakening. Higher dairy commodity prices may increase the caution in some markets, especially with a higher US$. Buying in some regions is close to trend but hand-to-mouth behavior will continue with ongoing mobility and macro uncertainty – not made any better by the discovery of the omicron variant.

The outlook sees a slowing in trade but that won’t alter the tension in ingredients markets given the limits on supply.

By Edwin Lloyd, General Manager Commercial, Maxum Foods – Your partner in dairy

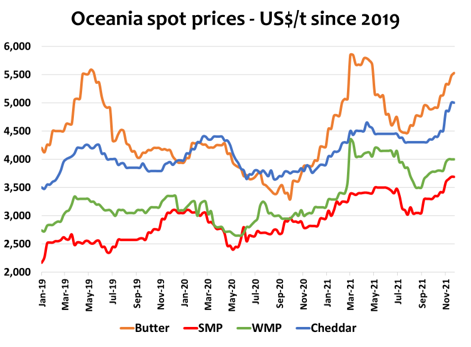

Graph Reference: Fresh Agenda