Global Dairy Commodity Update February 2025

Market conditions across major producers are increasingly diverse. The EU butterfat market is weakening with higher seasonal availability, but the outlook in H1-2025 remains uncertain, heavily dependent on spring pasture conditions, ongoing effects of disease on productivity and weakening consumer sentiment. The diverse milk supply landscape is expected to provide net small growth through H1-2025. The impact of the outbreak of Foot and Mouth in Germany is still being assessed. Germany have thus far confined the outbreak to one location. If this continues, it will minimize disruption, but any true impact is yet to be properly felt.

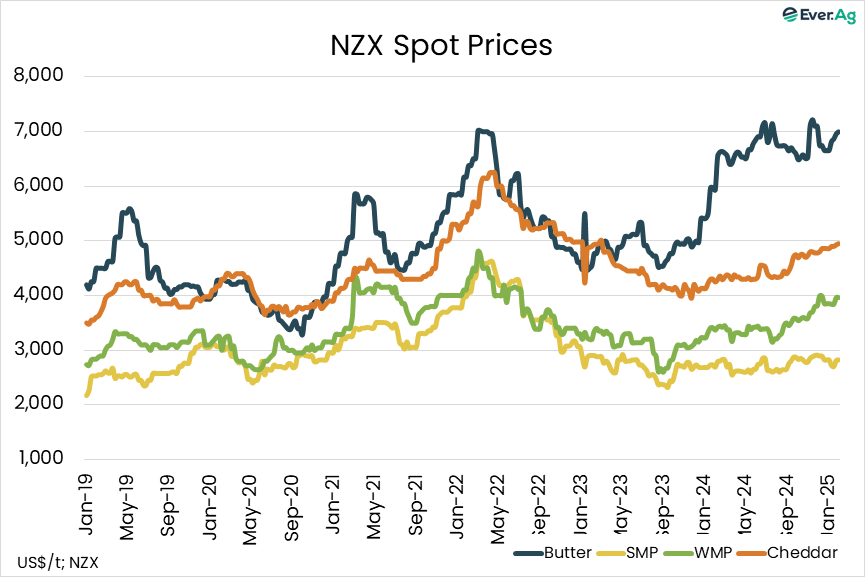

NZ producers have carefully matched ingredient output to demand, firming prices, while meeting opportunities in high-protein markets. Milk output in H1-25 is heavily weather-dependent but will likely sustain small year-on-year growth. Product mix remains a fine balancing act with limited growth in commodity milk powder output, despite lower EU and US output.

The continuing acute shortage of heifers has recalibrated expectations for US milk output, now expected to grow a little more than 1% in volume in 2025. This will slow the rise in output of new cheese facilities. Cheese trade with contested export markets will remain a focal point in Q2-25, with improving US supplies and various influences on EU exports.

The hostile, protectionist trade agenda of the Trump administration may raise further tariff barriers for US trade (in and out) to impact whey protein and cheese markets.

There has been evidence of front-loading of trade in several commodities. The impact of promised fiscal and monetary policies will continue to influence macro-economic conditions.

Australian milk output in southern regions slowed in December due to dry conditions. The weather outlook has improved, with a better chance of above-normal rainfall and higher temperatures across southern regions. Milk supplies will become tighter through summer with slowing production.

Small raw milk price increases are at this stage likely in Southern Australia with the easing of butterfat prices and possible pressure on global cheese prices.

Australia reported strong growth in cheese exports, up 24% YOY in the quarter to Nov-24, taking the rolling annual exports 28% higher YOY, taking advantage of the low AUD vs USD.

By Edwin Lloyd, Executive General Manager – Foods

Ph: +61 7 3246 7810

edwin@maxumfoods.com

Graph Reference: Fresh Agenda