Global Dairy Commodity Update December 2025

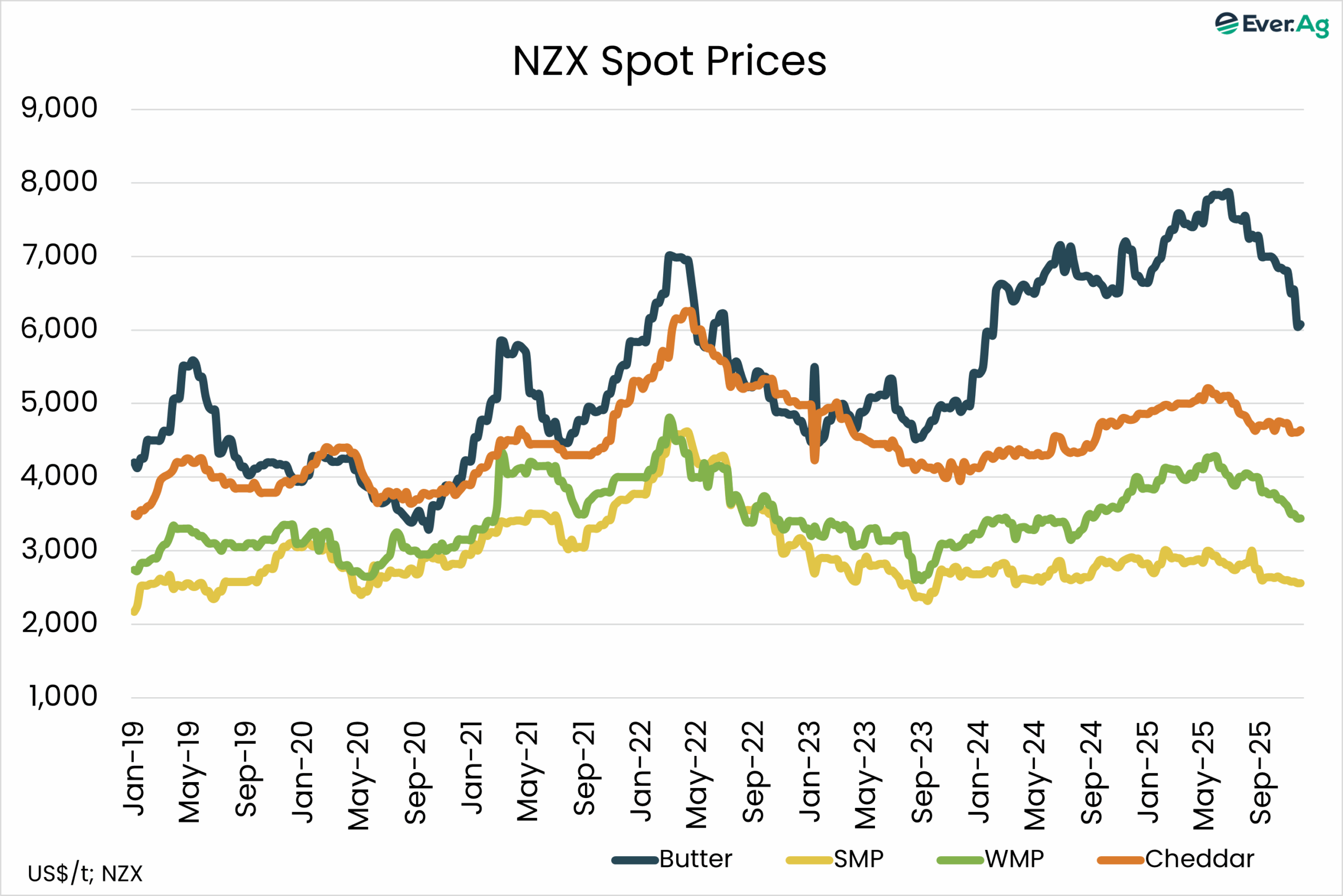

Dairy markets are increasingly oversupplied, and commodity prices have further downside according to our assessment.

Milk production growth continues to be exceptionally strong, while demand in large developed mature markets is anemic. Farmgate prices are falling but are still not low enough for farmers in key export regions to put the brakes on supply. It’s anticipated the breakeven point in the EU will be reached sometime in Q1-26, but cheap feed will ensure healthy milk growth by the time next year’s peak arrives. This timing will matter to prospects for price recovery.

Despite strong retail promotions, EU butter inventories are building at a historic pace – with estimates ending year stocks will more than double.

NZ milk production remains strong as Fonterra increased its own collections estimate for 2025/26 despite a lower milk price forecast. Demand signals from China are marginally positive, but that’s likely not enough to drive major price recovery.

According to official industry data, Australia’s milk production continued to decline through Oct-25. Local industry sources challenge this view, suggesting supplies are stronger than reported.

Conditions in South-West Victoria have drastically improved, with lower cereal hay prices compared to earlier in the year. Water levels in major Murray-Goulburn river system storages remained below the prior year except in Glenmaggie.

Ever.Ag’s 2025/26 milk solids output outlook is for a -1.9% fall, with lower production through Apr-26 given the reduction in cow numbers.

Retail dairy sales are solid this year. With lower global product prices, commodity milk value has declined since June 1 but farmgate prices have recently increased. Despite sizable exposure to falling global butterfat prices, the local cream price could seasonally remain elevated by Easter. Next year’s farmgate payouts are likely to be lower to start with but will get support from strong competition for milk in the local industry.

By John Hallo, Procurement Business Partner

M: +61 438 038 341

Email: john@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.