Global Dairy Commodity Update August 2025

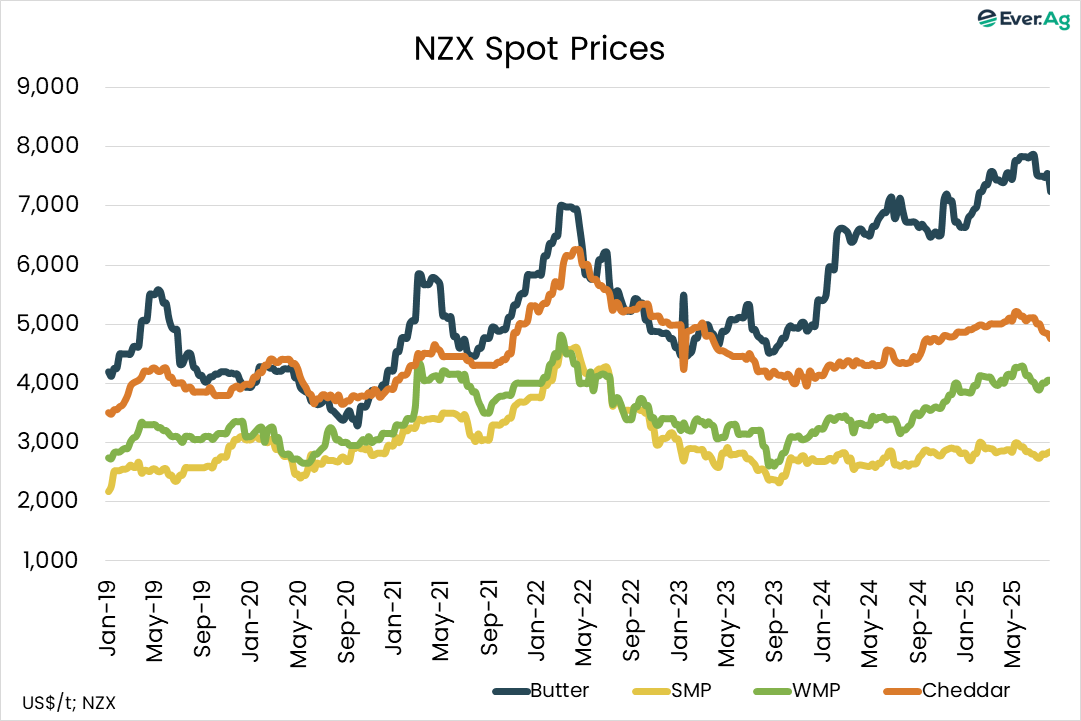

Global market fundamentals and product fair values are weakening with increasing milk output in H2-25. While tightness in EU milk and butterfat supplies is easing, abundant US cheese and butterfat supplies, and improving NZ output are eroding values.

The direction of the EU market is in the balance. A hot, dry European summer on already parched soil in many regions threatens feed supplies later in the year and presents lingering disease risks.

There have been limited BTV outbreaks to date which could be supportive of milk output. EU cheese demand is stable, yet butterfat demand has weakened, while cheese and butter exporters are losing share.

Production conditions are favorable in NZ ahead of the new season, but weather remains a key short-term influence. Milk output could grow a little last season’s strong result.

US fundamentals continue to weaken with strong milk and cheese production, weak domestic cheese demand and export growth that is inadequate to shift the dial.

Global trade continued to expand despite and due to much uncertainty, but some pushback against high prices was apparent in NZ’s June export trends.

While most of the US trade deals are claimed to be “done” at less damaging tariffs than initially feared, there is ongoing uncertainty as to what is in the detail affecting dairy trade.

Meanwhile the large shifts in US fiscal policy now enacted, and various geopolitical agendas, will continue to impact financial and commodity markets.

The rainfall outlook for August to October improved for eastern Australia, but southern regions in Victoria and Tasmania continue to face challenges. Recent feed shortages pushed hay prices to almost double those in May, but feed grain prices remain favorable.

Culling activity lifted to the highest monthly turn-off in more than 3 years, as cull cow prices spiked.

Freshagenda’s Australian milk solids production outlook is a 2% fall in in 2025/26, with a lower spring peak given the reduction in cow numbers.

By John Hallo, Procurement Business Partner

M: +61 438 038 341

Email: john@maxumfoods.com

Graph Reference: Fresh Agenda

To view PDF of this release, click here.